Tammy’s Toy Shop Case Studies

Situational Analysis

Evaluation of Santiago Enterprises(SE):

There are some problems identified within the SE, these are as following:

Problem no. 1:

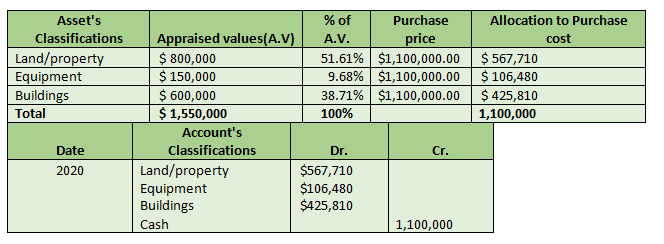

The company have purchased some assets for about 1.1 million, which as per the company books are not reported correctly. Their transactions were not recorded on the basis of their appraised values. The correct journal entries to these transactions are as follows.

Problem no. 2:

19 % of shares are owned by the company in the Acme Toys and Games Inc. (ATG) shares. $110,000 were paid by the ATG as dividends but only $8,500 were recorded by SE. based on the equity approach, initially the investment’s recognition in a Joint Venture (JV) is recognized at cost and for the recognition of investor’s portion of profit/loss after the acquisition, the carrying amount is reduced or increased. After the investors portion is determined it is the recognized in is profit or loss account. Any profit or loss received is subjected to make changes to the carrying cost of the investment. The adjustments are also required to the carrying amount in case of change in investor’s share of interest in the investee in case of changes to its comprehensive incomes, which might arise due to the PPE revaluation or from any kind of forex difference. The investor’s proportionate in these changes is recognized as other income of the investor. Hence with 19% of shares the correct amount of dividends would be $20,900 that needs to be updated in the book.

Problem no. 3:

Tammy has equity investments cost of about $340,000 with it market value of $380,000 at the year-end. Since the company is likely to go public, according to IFRS the equity should be recorded at its market price and accounts payable i.e. bonds payable should be recorded at face value, and both accounts must be recorded under the liability section. Hence equity investment should be recorded at $380,000 and bonds payable at $500,000.

Problem no. 4:

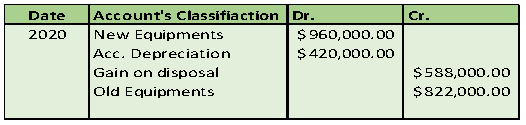

The company decided to exchange its tablet manufacturing machine with another one. The machine’s cost was $822,000 with its accumulated depreciation accounted for $420,000. Whereas, the machine would cost around $960,000 with accumulated depreciation accounting for $444,000.The machine’s fair value then was $480,000. The company had recorded $78,000 as gain. According to IFRS if any new asset is acquired by the company in exchange of another similar asset then that should be recorded at its fair value. Hence the gain recorded by the company on disposal pf the machine was not correct. The correct method is as follows.

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.