Strategic Cost Management and New Technologies Case Help

Introduction

VMD is the local self-regulating center that provides medical imaging services. However the center offers various services that include various radiographs i-e X-rays, Fluoroscopies, CAT Scans Computer Axial Topography, and MRI scans (Magnetic Resonance Imaging). However, each service provided by VMD has a different cost and function so that is why the center charges.

The main aim of the VMD is to expand the imagining technology through various innovations in the imaging technologies through various techniques. As VMD is the imaging center so it introduces various innovations in the imaging like the addition of machine to gain noteworthy benefit over its competitors with approvals from VP of Sales and the Director of Operations.

Problem of Statement

AS VMD is the imaging technology is the local independent center that provide medical imaging services to their customers while the center is facing some significant challenges. The company took various initiates regarding cost cutting, efficiency improvements but instead of raising the profit VMD is facing reduction in the profit their prices are becoming uncompetitive. This is a threat for VMD it is because due to reduction in the profit a due to uncompetitive prices their customers seeks alternative suppliers for the imaging services.

The VMD have not the proper cost management system that affects the profit of the company as well as the customers’ value so that is why most of the customers preferred to alternative center that is Winthrop Nelson Emerald due to the uncompetitive rates of VMD.

Situational Analysis

Answer no. 1

The one-pool costing system that the company is currently using has some pros as well as cons.

Pros:

- The main pros of one-pool costing system is that costing operations in such systems are quiet simple as compared to other costing systems. It is comparatively very easy for the companies to allocate costs by using this kind of costing systems because they do not allocated costs from different classification of accounts.

- The one-pool costing systems are comparatively easier to understand than the Activity based costing systems. The calculations that are required in one-pool costing system tends to be easier. Whereas the calculations in other than one-pool costings systems are complexed and difficult to understand.

- Although like Activity based costing, one-pool costing does not help to specify the costs but using this costing system make it easier to trace all sorts of direct costs incurred in operations.

Cons:

- The one-pool costing system does not offer the accurate cost that are actually incurred by a company rather it allocates costs to different cost account on an average basis.

- Because of providing average costs for different cost accounts, the one-pool costing system does not offers calculations for unanticipated costs incurred in operations.

- In one-pool type of costing systems, the calculations for all sorts of indirect costs are being ignored, due to which it becomes difficult to trace for the costs of waste that ultimately creates difficulties in taking cost cutting action.

Answer no. 2

Following are the reasons which signed that the current costing system for the company has obsoleted.

It became difficult for VMD to calculate for the costs of waste that occurs during the operations, that is why the company could not take proper measures for cost cutting process. For say, the MRI machine was only 10% utilized by the company but due to one-pool costing system, it was difficult for the company to allocate accurate or actual costs to its accounts.

The customers’ satisfaction level was decreasing because of the unjustified price level from the company. The customers were having different types of services almost similar rates, therefore as compared to the competitors the company’s pricing tends to differentiate at a greater extent.

The company was having a true representation of different cost accounts as compared to its competitors. That is why it became difficult for the company to cut costs and increase its profit margins ore allocate fair costs to different cost accounts.

Answer no. 3

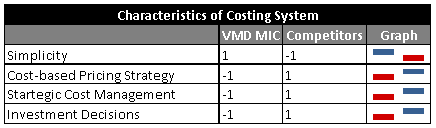

To illustrate the win-lose situations regarding the characteristics of costing system of the company as compared to its competitors we have created a following graph. We have created the graph by using the win-lose spark lines in Excel.

Simplicity: It is a win for the company in terms of simplicity because the company’s costing system is not complexed just like its competitors as they uses a costing pool to allocate costs for it machines.

Cost-based Pricing Strategy

It is a lose for the company in terms of cost based pricing strategy because their pricing strategy is not accurate as its competitors.

Strategic Cost Management

In terms of Strategic Cost Management it is a lose for the company because the company does not know how to effectively manage their costings system that is why they want to bring changes in their costing methods .

Investment Decisions

It is also a lose for the company in regards to investment decision because their costing management is not good, if the management is poor compared to the competitors then it is obvious they would find difficulty in making decisions regarding further investments opportunities.

Answer no. 4

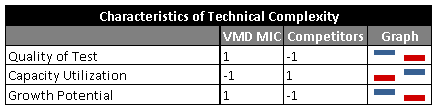

Quality of Test

In terms of quality of tests, it is a win for the company as compared to its competitors because the equipment and machines used by the company are very advanced so the test results generated out of these machines would most likely to be of high quality.

Capacity Utilization

In terms of capacity utilization it is a lose situation for the company as compared to its competitors because it is mentioned in the case that the company’s MRI machine is utilized only 10% of its capacity, 90% of its capacity is not being utilized by the company. Hence in that case, it would be considered a loss for VMD MIC.

Growth Potential

The company’s growth potential would be considered higher than its competitors because as mentioned above the company uses highly advanced equipment for its operations. With high quality of tests and more advanced equipment utilized by the company for their operations, it is understood that there would be higher demand for the company in future as compared to its competitors. Hence the growth potential of VMD MIC would be higher and it is a win scenario for VMD MIC....

Strategic Cost Management and New Technologies Case Help

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.