Machinery International (A) Case Study Analysis

1. What could be the possible impact of using the LIFO inventory accounting rather than FIFO?

From the law it can be seen that the company should utilize that cost for written down of inventory measured at the lower of cost and the net realizable value. If the company uses LIFO inventory accounting rather than FIFO, the company would no longer be required to consider the replacement cost or net realizable value. Inventory which is carried at cost for the translation purpose should use the functional currency which probably requires the written down in the functional currency financial statements even if written down is not required.

2. What could be the possible tools for mitigation of the foreign currency? Explain each of them.

In order for mitigation of the risk in the given case, the company can undertakes different kinds of tools including the use of forward contract which tries to help the company from the translation risk but could create problem in the case if the value of dollar is appreciated. The risk at then can be mitigated by fixing the current spot rate for the company. The benefit of using the forward contract is that it is customizable which can provide the advantage of adjusting the amount of royal payments.

The forward contract described as above can be used as the derivative instrument in which the underlying asset would be the Royal Payments which requires no initial payment and can help significantly in the future. The company could also consider the use of cash flow hedging which can significantly reduces the variability in the possible exchange rates. By using this kind of hedging all the gains or losses incurred by the company are recorded in the retained earnings which could significantly help the company in maintaining its good position in front of the stakeholders of the company.

3. What could be recommendation for the company from the different alternatives available?

By analyzing the overall situation of the company, it can be seen that the three alternatives available with the company for mitigation of the overall risk of translation are given below:

- The company does not enter into forward contract.

- The company enters into forward contract on January 1, 2001

- The company enters in forward contract on March 31, 2001.

The analysis of the three alternatives summarizes that the company should go for the second alternative as it is giving the more favorable result and could significantly reduces the risk of any kind of currency of exchange.

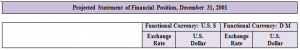

Exhibit 1

.........................

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.