"LULULEMON ATHLETICA: PRIMED FOR GROWTH" Case Study Solution

Introduction

Lululemon Athletica's chair & principal product designer is getting ready to speak to a stakeholder meeting audience (Eric A. Morse, 2006). He recounts lululemon's meteoric rise from 1998 to 2006, as well as it faces the future growth opportunities for analyzes. Originated in 1998 as a designer, producer, & dealers of women's sportswear, lululemon had opened stores in Canada, the US, &Australia within eight years of its founding. In 2006, the company expected to generate over hundred million dollars in revenue. Wilson considered lululemon's outstanding success and its potential opportunities in the coming years as he prepared to speak to the audience. He questioned how he could convince that lululemon did not overreach itself while pursuing shareholder-friendly expansion methods.

Problem Statement

Lululemon Athletica's chair and main product designer will speak to an audience at an investor's conference. He verifications lululemon's dramatic rise from 1998 to 2006 and inspects the company's future growth prospects. This scenario explains competitive advantage in connection with functional and emotional marketing motivations. It also highlights the significance of maintaining brand equity and chasing strategic growth options.

Question 2 (a) Evaluate Lululemon's Current Strategy

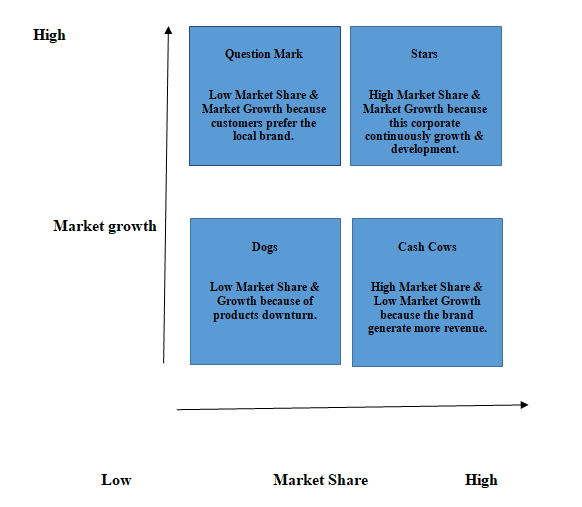

The evaluate Lululemon's strategy is the BCG Matrix strategy model is employed for Lululemon Athletica in this scenario; this strategy matrix is used to calculate the organization's existing state in high and low market growth matrix & market shares matrix, in which the organization knows the current position of units or product lines. Through this matrix, the company will decide which goods or entities to keep, sell, or invest in further.

Question 2 (b) Assess the Urgency for Action this Strategy

The BCG Matric for LULULEMON ATHLETICA

Question Marks- Quadrant 1

The first quadrant question marks must determine whether to enhance them by pursuing aggressive strategies such as market penetration, market expansion, and product development, or by selling them. As a result, in Lululemon Corporation's matrix is that the local brandsSBU is a question mark. Customers are progressivelyconcentrating on local brands, according to current trends in the industry so, this is the reason for this market is expanding quickly. Lululemon Corporation holds a small percentage of the market in this category. Lululemon Corporation should spend in growth, establishment&exploration to come up with novel structures, according to the suggested plan. This product expansionmethod will confirm that this SBU becomes a moneymaker in the upcoming time, generating revenues for the organization.

Stars- Quadrant 2

Lululemon Corporation has a star rating. Stars are high-share firms with high growth. Stars frequently require large sums of money to fund their quick rise, and they eventually slow down and become cash cows. Lululemon Corporation is a star because it has a large market share and is booming. Because their market share is minimal, they are near the bottom of the chart. Lululemon Corporation should continue to invest in its men's line and Ivivva brand in order for them to expand and become cash cows.

Cash Cows–Quadrant 3

In the Lululemon Corporation matrix, the dealeradministrationfacilitySBU is a moneymaker. This has been in operation for periods and has generated a substantial quantity of revenue for Lululemon Corporationhas a huge market share, but the wholemarketplace is decreased as businesses control their dealers instead of expanding them. Lululemon Corporation should stop investing in this corporate and continue to function this SBU as extended as it is gainful, according to the recommended approach.

Dogs–Quadrant 4

In this sector, the company is operating in a slow or low-growth industry, and businesses are frequently liquidated, divested, or reduced down through retrenchment, resulting in usingpolythene bags. For the previous five years, this critical SBU has been in the red. It also takes part in a market that is shrinkingbecause of growing environmental degradation. Lululemon Corporation should divest its crucial business unit to reduce losses.

The artificial fiber goods are also the reason of downturn of this corporation.Lululemon Corporation has lost cash for the past three years. It only grips a five percent market share. Lululemon Corporation should divest its strategic business unit to avoid more losses, according to the recommended approach.

LULULEMON ATHLETICA PRIMED FOR GROWTH Case Study Solution

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.