Launching a New Motor Oil Case Solution

Introduction

Avellin was laid out as an oil purifier in the United States in 1936. The company has advanced its position towards the oil division. But unfortunately, after a few years of inception, Avellin faced terrible issues of economies of scale among its rivals which brought down its overall revenue occupied with refining and showcasing oils. To support, Avellin centered its organization towards different industrial and automotive parts. Notwithstanding, it has been seen that the auto business has come forward with approximately 60% of the income benefit for Avellin.

By 2014, Avellin did with the ten-oil mixing and bundling plants along various appropriation channels for its oils. Like its opponents, Avellin additionally integrated a quick-lube chain. These stores were Avellin Auto chains. The company has come into the number three position in the business as compared to its other rivals. Avellin, since there are a number of rivals in the market giving tough positions for the Eco7, had just a single friend on the lookout, which was SevoGreen.

Problem Statement

Aaron Jonner son is facing a challenge to launch their new product Eco7 in such a competitive environment with a commoditized market and price sensitive consumers. The Vice President has the challenge to decide their strategy related to distribution channel and pricing for Eco7 before its launch to cater high expectations of shareholders with Eco7

Situational Analysis

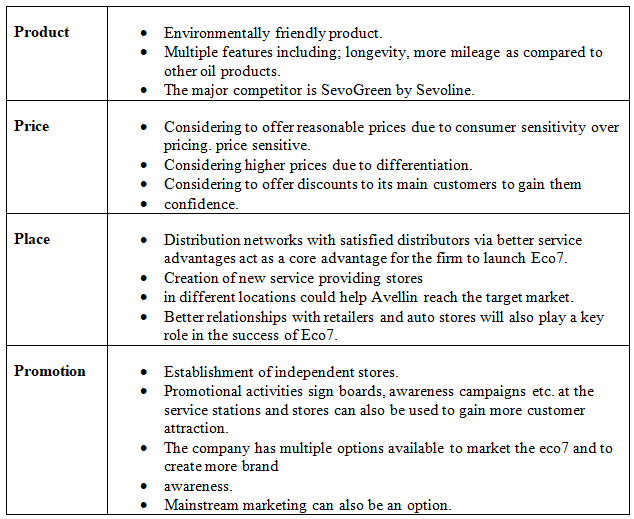

Before recommending an optimal launching strategy for Eco7, a detailed analysis of the company’s internal and external environment and an analysis of the four Ps of marketing of Eco7 is conducted.

Internal Analysis: SWOT Analysis

Despite high brand loyalty for Avellin products, the company has sluggish growth in its revenues because of the lack of innovation in its products. Along with it, introduction of Sevogreen by Sevoline, high competition in the market poses various threats to the firm. In this situation, being a 3rd PCMO manufacturer, Eco7 can be proved as a good opportunity to cater the competitive threats and earn potential revenues. See Appendix 1.

External Analysis: PESTEL Analysis

Overall, the external environment seems to be posing various challenges for the firm in launching its new product. Lack of financial management abilities, issues with the cash flows, limitations over IP rights, attitude of global technology providers for Taiwan are various challenges faced by the firm in launching its new product. However, political and environmental support through contributions for human resources and development due to its eco-friendly nature brings various opportunities to launch Eco7 successfully. See Appendix 2.

External Analysis: Porter’s Five Forces Analysis

Overall PCMO market seems to be highly competitive and dynamic with high buyers’ and suppliers’ bargaining power due to availability of substitutes and quality requirements to be competitive in the market. Along with it, high threat of new entrants of the market due to market potential and presence of a number of competitors in the market makes it more difficult to gain a high customer base with loyalty. In this regard, product differentiation, continuous innovation, good relations with suppliers and competitive pricing are some key areas to consider to gain huge market share. See Appendix 3.

Product Analysis: 4 Ps of Marketing

Product Analysis: Financial Analysis

It is known that Eco7 is an environmentally friendly product with the price range of 5.25dollarsto 6.75 dollars. It has been finding out the conventional pricing is not good for the company as the up gradation of company towards the conventional will result the conversion of customers towards the competitors’ products. So, the conventional pricing for Eco7 product is not good for the company. Along with that, the economics and incremental analysis have been done for Eco7as it has a price range of 5.25 dollars to 6.75 dollars and find out that the discounted price ofEco7 which is 5.25 dollars is also not good for the company as it is increasing the demand from1260 units yearly (when price is 6.75 dollars) to 1620 units yearly (when the price is 5.25dollars) but reduci9ng the total gross profit to (3746) (when price is 5.25 dollars) from 3938(when price is 6.75 dollars). See Appendices 4,5 and 6.....

Launching a New Motor Oil Case Solution

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.