Dividend policy atLinear technology Case Solution

The returning of cash to its shareholders or not would be unsafe for the company if the company took an irresponsible decision, in this situation, Linear technology corporation should not return the full amount to its shareholders that are around $1.5 billion it is because the current situation is not healthy for the company and the market and the holding of cash would allow the company to invest into new profitable projects that would help the company to avail the opportunity to sustain and increase the growth rate of the company. However, the company could return cash to its shareholders in the form of repurchasing stock despite dividends. It is because the repurchasing of stock is feasible for the company as the company had faced a decline in sales($47 million) in 2003 which was lower than that of the previous year i-e $54 million.

So repurchasing stock would be a productive option for both company and shareholders that allow the company to reduce the outstanding shares and it would enhance the stock price as well as the earnings per share. Furthermore, the holding of cash would increase the expenses of the company in the form of taxes so the company should the tax by reducing cash flow and increasing the payments to employees and the R&D while the company could enjoy the cheap tax by financing the project with debts. (See appendix-2)

Question No 4

Dividens and repurachsing stock

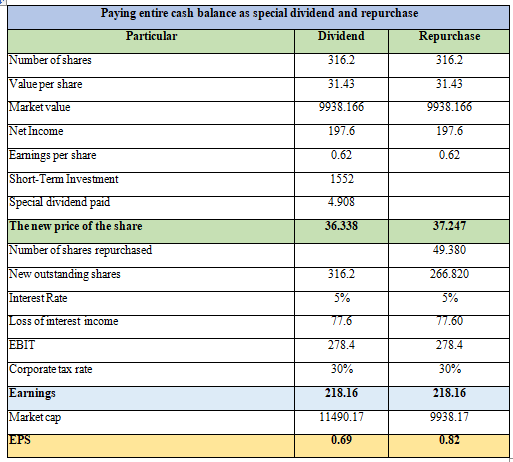

The dividend that the company would pay to its shareholders will be 4.90, which is calculated by the cash and short-term investment of $1552 million by the number of outstanding shares. The price of the share after paying a dividend is $36.33, which is calculated by adding the value per share to $31.43 and payinga dividend of $4.90. Additionally, the earnings of the company are calculated to be $218.16 million; whereas the earnings per share are calculated at 0.68 (R, 2020).

The case analysis of the company indicates that if the company would pay the entire cash to the shareholders in the form of dividends then the expected outstanding shares would be around $316.2million while the value per share would be around $31.43. The market value can be calculated by multiplying the outstanding shares number and the value per share hence the total market value would be around $9938.166 million.

From a net income of $197.6 by the outstanding shares, the current earnings per share can be calculated as $0.62 hence the company would pay a 4.90 dividend to its shareholders which are calculated by the cash and investment ($1552 million short-term investment) by the number of the outstanding shares (Romus, 2020).

Subsequently, to calculate the number ofnew outstanding shares the number of shares repurchasedis deducted from the existing number of outstanding shares. The price of the share would be $37.24after paying cash to shareholders as a repurchase, which is calculated from the division of the market value of new outstanding shares. Furthermore, the total earnings are calculated as $218.16 million, while 0.81 is the earnings per share (Wagonfeld, 2003).

Financial analysis

The financial analysis of the company in the current scenario indicates that the company can sustain its growth rate if it opts for the repurchasing options rather than the dividend option because the stock prices possibly increase if the company decided to give a dividend to its shareholder while the earning per share would be greater if the company opt the repurchasing the share it is due to the reduction of the number of outstanding shares and increase the price of the stock (Kadim, 2020).

Question No 5

Recommendation to the CFO of the company

The critical analysis of the case shows that the most flexible option for the company is stock repurchasing rather than the dividend policy and it will be disruptive for the company if it decided to increase the dividends. Hence Paul Coghlan should avoid the increase of the dividends by escapist his core attention over raising the shareholders’ value. The current market situation is not feasible and has aggressive risks so CFO Paul Coghlan should avoid the increase in the dividends. However, it is recommended to the company repurchase the shares in the situation of the cashreturning to the shareholders.

Furthermore, it will be profitable for the company to invest in such projects that can generate profit and invest in profits-generating projects with a confident net existing value. Additionally, to this, it is recommended to the company exploit and imprisonment the accessible chances for patter the Asian market as the company hasn't discovered any plan with progressive NPV yet (Singh, 2019).

Conclusion

Linear technology is the top leading company that has a strong market presence in the global market while having a deep-rooted business in the semiconductor industry. The company was considered the world's largest company according to the SOX ranking. Linear technology has a wide and penetrated market but the company faces a decline in sales and profit since the set of Initial public offerings in 1896. However, it was the most challenging for the CEO of the company to increase or retain the dividends while the wrong decision could disrupt the market as well as the business of the company(Wagonfeld, 2003).(See Appendix-3).......................

Appendices

Appendix-1 Share Repercash Policy effects

Appendix-2 Paying entire cash balance as special dividend and repurchase

Appendix No-3 Recommendations

Dividend policy atLinear technology Case Solution

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.