Depreciation at Delta Air Lines: The “Fresh Start” Case Study Solution

Certain adjustment in financials

The depreciation makes certain adjustments in the income of the company generated on periodic basis. The companies increases the estimated useful life of assets with the intent of reducing the operating expense that is depreciation expense. The depreciation method is a technique which is widely used to adjust the profitability through increasing the estimated lifespan of asset.

Methods of asset valuation

In investing, the fair value method is being used by Delta Airlines which refers to the sale price of asset agreed upon by the willing seller and buyer. The different methods which can be used for the asset valuation are discussed below;

Cost method

One of the most preferable method is the cost method for the asset valuation. In this method, the assets are listed on the financial statement of the company on the basis of the price at which those assets have originally bought. This method is based on the past transaction of the company and is easy to calculate, reliable and conservative.

It enhances inter-comparability (comparing financial statement of one entity with the other entity’s financial statement) and intra-comparability (comparing financial statement of company in each year to the financial statement of previous years) of the company’s financial statements. It avoids the tedious procedure of restating financial statement amounts and additional cost which is associated with the revaluation of asset.

Fair value

Another method is the fair value for valuing assets that allows for accurate balance sheet and it better reflects the current value of liabilities and assets. The value of these liabilities and assets is reflective of market of the business, hence provides the up-to-date insights to the currents state of the market. Not only this, it provides objective foundation for future cash flow’s evaluation. It also facilitates the evaluation of effectiveness of the management of the company(Tkachuk, 2019).

Base stock method

It is a valuable technique used for the asset valuation where the minimum amount of required inventory is recorded at its cost of acquisition. It is valued at the historical cost and treated as the fixed cost, but with minimal depreciation scope. It also requires fundamental changes for the purpose of coping with the changes of capacity of production as well as policy makers related to the inventory or stock.

Conclusion

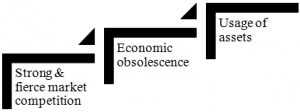

While estimating the depreciation, Delta Airlines has changed the assumptions related to the aircraft residual values and lifespan four times in the last 30 years due to the competitive pricing and intensive competition, discount airlines and introduction of hub and spoke route system, deregulation during these periods, reduced annual depreciation to report reduce losses or higher net income. The determinants of the aircraft useful life includes strong and fierce market competition, economic obsolescence and usage of assets. The purpose of depreciation in reporting on assets and periodic income includes achieving matching principle, reporting of assets at net value and certain adjustment in financials. Also, the methods used for the calculation of asset valuation includes base stock method, fair value method and cost method.

Delta Airlines uses air value method which allows for accurate balance sheet and it better reflects the current value of liabilities and assets but it is cost and time consuming leading to significant rise in the financial troubles associated to the reporting of financial of the company. Consequently, Delta Airlines need to be conservative in asset valuation and estimation of asset’s useful life to strengthen its foothold in the market.

Exhibit A- Determinants of aircraft life

Exhibit B-Methods of asset valuation

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.

How We Work?

Just email us your case materials and instructions to order@thecasesolutions.com and confirm your order by making the payment here