Cree Inc.: Introducing the LED Light Bulb Case Study Solution

Internal Analysis:

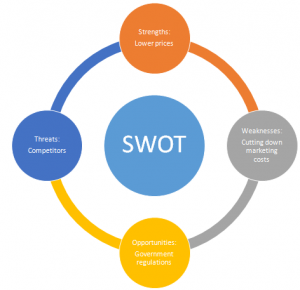

SWOT Analysis:

Strengths:

Cree is the only company who is supplying LEDs at such low prices and a warranty of 10 years. The company is vertically integrated and this gives the company an advantage over other companies as it make sits own raw materials, it does not have to buy from the suppliers. Thus the raw materials it uses is cheaper and it does not have to pay extra for it.

Weaknesses:

The company has been saving the marketing costs, it was advised to have spent $100 million annually but it preferred to spend less than $20 million. The company has no recognition in the market, and people are unaware of the company and its services. The company should spend more money on advertisements and in spreading awareness of the technology that the company has launched in the market. Marketing can be a great way to boost the company’s sales,which would enable it to become a market leader.

Opportunities:

Government regulations have derived the change in the market trends. People used to buy the incandescent bulbs, even though they were inefficient. The regulations demanded better quality and more efficient bulbs due to which the traditional bulbs were replaced with halogen-based incandescent bulbs. These bulbs are expensive than the previous incandescent bulbs. Now Cree has the opportunity to take over the market share by advertising itself as the next best alternative which is cheaper, efficient and with a longer life expectancy.

Threats:

The major threat to the company is the competitors, who are the major players in the market. The company has not been recognized yet in the market, but the competitors are well known and well established in the market. They can introduce a cheaper or a better product that might attract the customers. The people know those companies so they will definitely trust them and move towards the more recognized brands.

Financial Analysis:

In Exhibit 3 the company’s income statement is shown for the period of 2010 to 2013. This shows how the company experienced profits after the launch of the LED bulbs in 2013. The revenues grew rapidly and so did the profit. In order to understand and estimate the future sales; we have taken an average of revenue and expenses. If all the aspects stay ceteris pari bus then we can indicate the sales of the coming years.In Exhibit 4 we have shown budgeted sales and indicated the profits that the company can generate. The budgeted sales show a profit in the following years, it is not as high as the previous years, but the company is not making any losses. If the company invests in advertising, it might increase the sales and leads to higher profit generation.

Conclusion:

Cree has been successful since the launch of the company. They have been serving the industry since 1980s. The company has been working for businesses for a good long time and so they do not have any brand name in the market of consumer goods. Now with the changing trends and altered government regulations; the company has got a chance to cater the consumer market. They need to establish themselves in the market as they are competing the big multinationals who have been the market players from a long period of time. Cree has got a competitive advantage,which is that they can control the cost of the light bulbs and cater the market at very cheaper prices. Other companies do not have this opportunity as Cree is vertically integrated unlike other companies.

Recommendation:

Cree has got the potential and sustainability with intelligence and the R&D that can make them the market leaders. Their product is efficient and low priced, but they are not hyped because people do not recognize the brand. Secondly, the customers always look for good deals so in order to increase the sales they can give bulk discounts and introduce market penetrating offers. The company should have a good after sales service, which will keep the customers loyal to the brand.

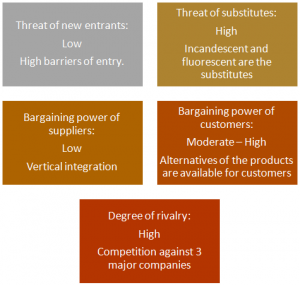

Exhibit 1:

Exhibit 2:

Exhibit 3:

| 2010 | 2011 | 2012 | 2013 | |

| Revenue | 867.3 | 987.6 | 1164.7 | 1386 |

| Cost of goods sold | 456.2 | 551.8 | 755.2 | 862.7 |

| Total Gross Margin | 411.1 | 435.8 | 409.5 | 523.3 |

| Total Operating Expenses | 213.3 | 267.1 | 370.2 | 426.8 |

| Operating income | 197.8 | 168.7 | 39.3 | 96.5 |

Exhibit 4:

| Budgeted Sales | |||

| 2014 | 2015 | 2016 | |

| Revenue | 1275 | 1331 | 1303 |

| Cost of goods sold | 809 | 836 | 822 |

| Total Gross Margin | 466 | 495 | 481 |

| Total Operating Expenses | 399 | 413 | 406 |

| Operating income | 68 | 82 | 75 |

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.