Bain Capital: Outback Steakhouse Case Analysis

Introduction

Bain Capital is a well-known private equity corporation that operates globally. The company was established in the year 1984.(Paul A. Gompers, 2012)The company identified with its brand name that is Bain Capital. The company is always trying to grow the business by making multiple investments in about 230 corporations. Bain Capital makes alliances worldwide to acquire the most profitable and reputable companies that increase the efficiency and market value of Bain Capital. The Brain Capital is also involved in raising private funds, which extended to about ten core funds. Areas of investment of the Corporation were mainly in capital growth, new business startups, and grabbing the opportunities for increasing the Corporation’s growth. In 2007, Bain Capital acquired the outback steakhouse fixed restaurant chain with the highest market value and customer base for providing a high-quality experience in the restaurant. The main aim of Bain Capital was to increase the profitability and attractiveness corporation by acquisition with Outback Steakhouse.

Problem Statement

After the Acquiring of Outback Steakhouse in 2008, during the period of recession, the company suffered from the problem of how to pay the debt? Because of the global recession, the sales of the Steakhouse constantly declined. How does the Bain capital manage the company’s debt by improving the performance of Outback Steakhouse?

Debt Management

As the company faces the debt management problem, how to manage the debt with improving the performance of Steakhouse. Following are some analyses that help the company improve this issue.

The debt of the Bran Capital can be managed; some important are given below.

Following a fixed repayment schedule

This method is mainly used for the cash flow analysis; most companies follow a fixed repayment schedule. The company schedules the debt strategy centered on its maturity in this schedule. The fixed repayment schedule shows all three financial statements of income, balance sheet, and cash flows in a single schedule. The main components of the fixed repayment schedule are:

- Opening balance of the period

- Draws

- Repayments

- Interest expenses

- The closing balance of the period

Bain Capital also considers some factors when going for the fixed repayment schedule. Those factors are maturity of the debt, discounted rate, flotation cost, and capability to produce the gain.

Assume Future Leverage of the Company

The higher leverage is not suitable for the company because the higher the leverage creates, the higher risk for the Corporation. We must have a low leverage value for securing the loan. With low leverage, the company can achieve favorable terms regarding the loan, which increases the easiness of meeting short-term obligations and improves the problem of debt of Bain Capital.

Enhancement of Marketing

To increase the sales and performance of Steakhouse, the Corporation must improve its marketing to boost sales and attract more customers to the restaurant of Steakhouse. The Corporation must follow the following strategies to improve the performance of Steakhouse.

Customer Outreach

Customer outreach is the best strategy for increasing the number of customers. In this strategy, the company creates good relationships with the customers and continuously communicates and connects with them to understand their expectations and satisfy them.

Reservation links on the business link

The company must add the reservation links on the link steakhouse restaurant because most people want to reserve the dining tables online because of their busy schedules. It is the best strategy for the company to increase its performance.

Use the Guest Data

To increase the satisfaction of the customers, the restaurant management must collect the guests’ data and use it to increase the performance of the Corporation. The restaurant must be proactive about the guests’ performances and move accordingly.

Work on presentation of dishes

By observing the current representation of other competitors, the Steakhouse must change the presentation of dishes in dining that look unique when compared with other competitors. Most of the guests are conscious of the presentation of dishes, which increases their curiosity about dishes, so the presentation of each dish must be unique. The company also needs to work on the marketing mix to attain a competitive advantage.

Marketing Mix of Outback Steakhouse

The 4ps of the marketing mix are also essential to enhance the company’s performance and increase the brand image and market value.

- Product

- Price

- Place

- Promotion

Product

The Outback Steakhouse has a variety of products in high demand because of their high quality and fresh texture. The main products of the restaurant are Grilled Chicken on Barbie, Firecracker Salmon, Baby back ribs, and Bloom in Onion. Now the restaurant must introduce some other products to increase the sales.

Price

The Outback Steakhouse restaurant has higher prices on the products because of the restaurant’s weak performance during the global recession. To increase the preference, restaurants must reduce the prices of the products because guests want higher quality products at low prices.

Place

The Outback Steakhouse has 981 restaurants in the year 2011which,which offer products worldwide. In 1987, the Corporation was founded in the United States, and the first restaurant of the Outback Steakhouse, was in Florida Unites States.

Promotion

The promotion of the Outback Steakhouse restaurant is good but still increasing the performance of the Corporation. The restaurant must adopt advanced marketing technology and follow all the strategies that increase the Corporation’s performance.

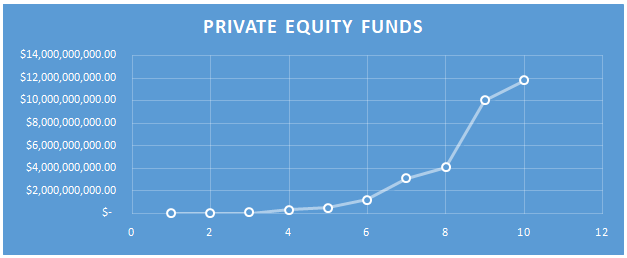

Private Equity Funds

All ten funds are listed in an Excel file through which we design the graph of private equity funds. The last fund, which is the tenth, has the highest equity of $11.8 billion.

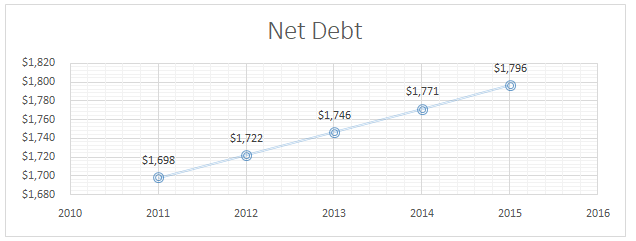

Forecasting of Net Debt

The debt of the Corporation is not constant in the forecasted years. The company’s debt increased from 2011 to 2015, which is not suitable for the Corporation. The company must improve its debt to increase its growth of the company….

Bain Capital Outback Steakhouse Case AnalysisThis is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.

How We Work?

Just email us your case materials and instructions to order@thecasesolutions.com and confirm your order by making the payment here