AT&T Versus Verizon: A Financial Comparison Case Study

Introduction

AT&T is world's largest telecommunication networking company in US it provides the largest services of Mobile telephones. It was founded by Allaxder Graham Bell and Gardiner GreeneHubbard1983 in Delaware, United States and its headquarter is in the Dallas, Texas United

States. According to the ranking of Fortune magazine, the AT&T was 9th largest United States Corporation who has the net revenue of $181 billion .It has a huge market in telecommunication networking and has world best ranked products which include.

Satellite television

Fixed-line telephones

Mobile telephones Internet Services

Verizon is an American wireless operating company that provide the wireless services in various countries and it ended 2021 with the subscriptions of about 142.8 million. It is founded by Vodafone, Verizon communications in 2000 in New Jersey, United States. The company provides various wireless services to its customers. It is the parent organization of the Verizon communications and it moved their services and products to various divisions like Verizon Consumer and Verizon Business. The Verizon Company offered various applications to easy excess for its services that is Bloatware. The products and services which are enlisted by Verizon

Include Wireless Phones, Wireless home phones, Mobile broadband and Wi-Fi. (Heilprin, 2017)

Problem statement

In this report we have compared the financial performance of both the companies. The financial performance of both the companies have been analyzed by identifying and analyzing their financial ratios including the debt ratios, operating ratios and profitability ratios. Through their financial performances the business strategies used by both companies and their implications has also been analyzed.

Situational analysis

(Question 1)

Financial Comparison of both industries

First we have analyzed the financial performance of both sectors i.e. the wireless sector as well as the wireline sector. From the financial data given for both sectors it could be analyzed that the income and profits in the wireless sector has shown an increasing trend whereas in the wireline segment it has been showing a declining trend. As it could be seen that in the wireless sector both companies has shown improvement in their net income where as in the wireline segment both companies have not performed well and their net income has been falling.

Hence it could be said that both companies should focus more on generating income through wireless sector and invest in the wireless industry. It could also be seen that the costs and investment required in the wireless sector are comparatively greater than the other sector but the improving income generated out of this segment has overshadowed its high cost and investment requirements.

(Question 2)

Financial Comparison of both Companies

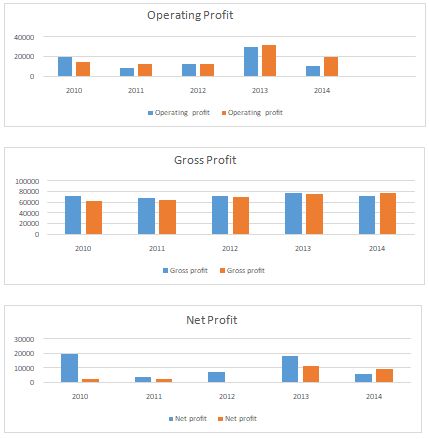

From the analysis it could be seen that as compared to AT&T the operating profits of Verizon are higher. Whereas the net profit of AT&T are higher than Verizon. Implying that the non-operating expenses of Verizon are much higher than AT&T which tends to decrease the net income of the company.

Question 3

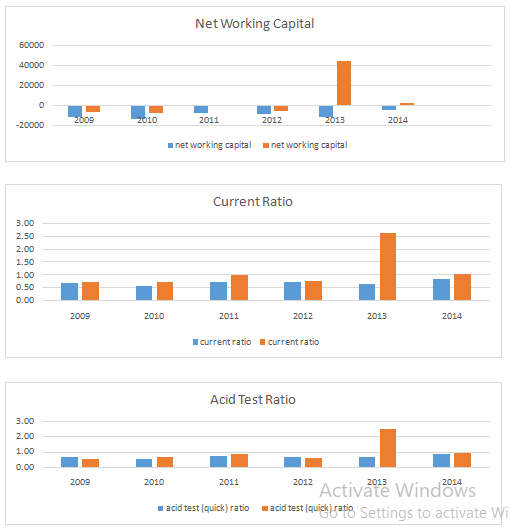

The current ratio, quick ratio and networking capital of Verizon are higher as compared to AT&T which means that the currents assets are higher than the current liabilities for the company.

Although Verizon has higher rates but the current ratio of Verizon are less than in the year 2009, 2010 and 2012 which is not good. Lower than 1 current ratios depicts that companies are not able to pay their current obligations out of their current assets.....

AT&T Versus Verizon A Financial Comparison Case Study

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.