Angus Cartwright Case Memorandum Case Solution

Problem Diagnosis

Mr. Angus Cartwright is a financial planner and he needs to make recommendations for real estate property investments for his long time family clients, which are the Delights. Judy and John Delight have come to Angus at different stages of their lives to seek advice and their interest for diversifying their investment portfolio so that they can also make real estate investments a part of their portfolio.

There are four properties, which have been identified in the case by Angus Cartwright for his two clients, which are cousins. He believes that all four of the properties are a perfect match for the clients but he will have to narrow them down to one property for each of the client. Therefore, we need to recommend which cousin should invest in which property based on the detailed financial analysis of each of the four properties and the additional modifications, which have been described by Andres and Still well in the case. The investor’s profile and then the investments will have to be analyzed before a final recommendation is made to Angus Cartwright.

Case Analysis

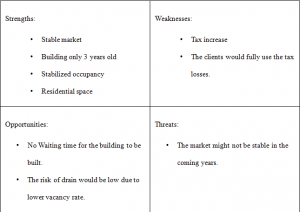

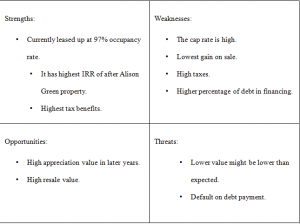

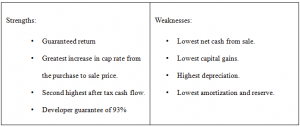

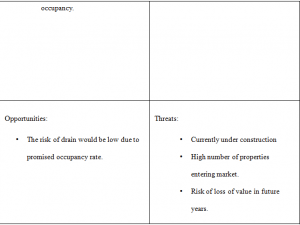

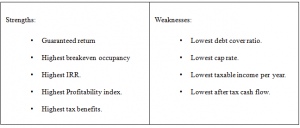

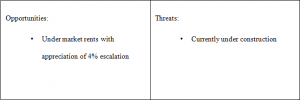

First, we have performed a SWOT analysis for each of the four properties, which are shown in the table below one by one

Alison Green

900 Stony Walk

Ivy Terrace

The Fowler Building

Investing Profiles of the Investors

John Delight

John Delight is the retired elder cousin. All of his wealth is invested in securities. His primary investment is in a startup company, which bought his startup company. He currently has $ 6 million in stocks and the main source of income are dividends, which he receives over his stock investment.

Angus Cartwright Case Memorandum Harvard Case Solution & Analysis

If at this point John does not diversifies and places all of his investments in one basket, it can prove to be risky for him especially in the share market. He is now ready to take out $ 3 million out of his securities to invest in real estate and diversify his portfolio. He wants to balance the risk in his portfolio by investing in the real estate market. His investor profile can be stated as a profile of a low risk investor as he wants periodic income payments or steady income stream. He would then be able to utilize it for his daily expenses..............

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.