American Home Products Corporation Case Solution

Debt Analysis

American Home Products now poses little danger. One aspect is that the business has historically operated without the requirement for debt. The establishment of a sizable cash reserve, or financial slack, by the corporation shows that it has faith in its assets. Overall, the small amount of debt, minimal fixed cost requirements, and low chance of default show that the company is financially strong. The nature of the organization’s product lines, which are mostly focused on human needs and everyday items, is another factor contributing to its low risk.

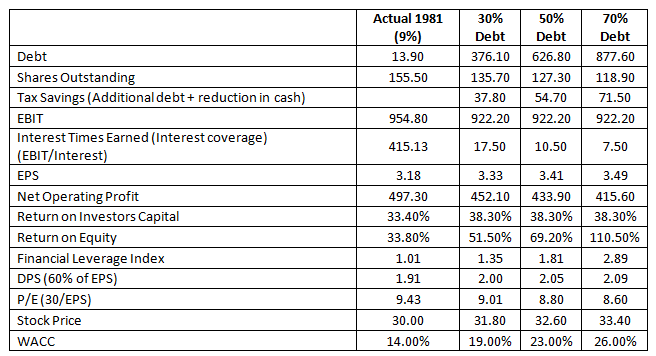

The corporation’s significant cash reserves show that there is little possibility of a debt default. At each of the stated thresholds, risk rises directly proportionately to debt. The firm can increase value for its owners by reducing taxes. Shareholder ROI increases from 33.4% to 38.3% when the capital structure is changed to a 30% debt leveraged capital structure. After this point, the company does not provide value for the shareholders if it leverages with greater debt than 30%. The very high score of 415.13 for the Interest Times Earned suggests that the company could profit from debt financing. The Interest Times Earned is 17.5 with 30% debt and reduces negatively with debt.

Advantages and Disadvantages

An increase in risk is one of the main drawbacks of taking on excessive debt. AHP will be responsible for a debt of $362.2 million at a 30% debt, according to exhibit 4 of the case. This amount increases to $612.9 million and $863.7 million, respectively, at 50% and 70% debt levels. This demonstrates unequivocally that AHP has a larger risk of bankruptcy the more debt it accumulates. A decrease in cash flow is another effect of taking on more debt. AHP will need to employ greater cash flow to pay down the debt. Due to the possibility that bondholder debt might take precedence over dividends, this has the potential to erode shareholder confidence.

However, one benefit of increasing debt is the tax shelter. Although bondholders would have to pay more in interest, AHP would pay less in taxes since interest costs would be deductible. Shareholders will profit if the tax shield is large enough to cover the interest charge. As debt levels increased, dividends increased as well, benefitting shareholders. According to the pro-forma statement, which is displayed in exhibit 3, dividends per share increase from $1.90 with no debt to $3.33 with 30% debt, $2.04 with 50% debt, and finally $2.10 with 70% debt. As a result, the relationship between debt and shareholder value in terms of dividends per share is obvious and linear.

Debt Rating

The capital structure strategy that AHP today employs is quite cautious. In order to pursue a more aggressive capital structure policy, AHP will have to issue more debt. The best way to raise debt is through bonds. Exhibit 2 demonstrates that AHP’s bond rating is AAA, indicating that investors will feel secure investing in AHP bonds and providing the company with more funding. The money will be used to buy back common stock for AHP.

Other techniques for boosting leverage are available to AHP. According to the argument, AHP’s corporate culture is extremely conservative and risk-averse. AHP would purchase and license new products from competitors rather than creating their own. With extra cash, AHP could be able to research and develop its own products. There will be a number of effects from this. The first is that it will reduce costs associated with previous expenses like product licensing and acquisition. AHP may now collect licensing and acquisition fees from its rivals because it is now the one creating and producing new products. Both of these factors will increase AHP’s cash flow well above what it would have experienced without taking on more debt.

AHP may use the extra money to purchase new machinery or to buy more firms. This AHP will be able to streamline the production process and boost output effectiveness. This has the dual effects of reducing production costs and raising cash flow, which improves the company’s bottom line and increases shareholder value. It is crucial to emphasize that AHP should gradually instead of suddenly add debt to their capital structure. This is especially important because Laporte will leave his position as CEO to create room for a replacement, and because excessive debt leveraging may undermine investor trust.

Recommendation

We advise Mr. Laporte and his successor to leverage their debt by 30%. For AHP, this has a number of benefits, especially in terms of its corporate culture. The case study claims that their current business culture is one of austerity. We recognize that Mr. Laporte might not want to increase his debt in light of this. The case study also reveals that the corporation is managed in its investors’ best interests. The company’s investors would benefit greatly from increasing the debt to 30% since the shares’ value would undoubtedly increase. This is likely to please shareholders and increase their confidence in the company, which might result in increased loyalty to the business.......................

Appendix: Debt Analysis

American Home Products Corporation Case Solution

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.