ACCOUNTING Case Study Analysis

Appendix 1

Accounting Issues, Analysis & Recommendations

- The Clean Eating Initiative

Issue

ICI has received a grant as compensation of 25% of the employees’ salaries and wages’ expense from April 1st, 2021 to March, 31st, 2022. The company’s fiscal year ends at July 31st, whichmeans that the company has received a grant for the current period expenses as well as its future expenses.

Analysis

According to ASPE section 3800 related to government assistance:

- The grants given by the government for current expenses must be included in determining the net profitability, i.e. the expenses must be netted with the amount received as a grant.

- However, grants for future expenses must be deferred and must be recorded if related expenses incur over the future period.

Recommendation

The actual employees’ salaries and wages expenses totaled $35000 from April, 1st, 2021 to July 31st, 2021. The calculated grant as 25% of preceding expenses amounted to $28000. So, the current salaries and wages expenses must be reduced by $28000, which will leave the salaries and wages expenses to be $7000 till the end of fiscal year July 31st, 2021. The grants for future expenses must be adjusted in the next year.

- Deep Fryer Malfunction

Issue

ICI has slight malfunction in its fryer and the owners have to decide whether to sell it or keep the fryer with minor maintenance. The fryer was purchased at $1400, four years ago. An amortization of $700 has recorded till now and if it is sold; the company will receive $400. It is believed that the truck could continue operating for up to four years.

Analysis

According to ASPE Section 3063:

An impairment loss should be recorded, if the assets’ carrying amount is not recoverable and exceeds its fair value.

Recommendation

Though the company has not decided about selling the fryer in the market, so no impairment will be recorded in the financial statements of fiscal year 2021. The impairment loss will be recorded if the company sells the fryer and fair value of the fryer which does not cover the carrying costs.

- Inventory Error

Issue

The inventory of $2800 received in 2020 is actually recorded in the year 2021, when the invoice was received and paid. No entry was made in this regard earlier.

Analysis

From the aforementioned issue, it can be observed that the inventory is not recorded in 2020, when it was actually received. It would overstate the amount of inventory for the current period. The company follows the periodic inventory system; whereby the physical count of inventory would be conducted and then the amount of inventory would be reported in ledger. The inventory as per physical count would be lesser than the available inventory in the company’s accounting records.

Recommendation

It is recommended to adjust the inventory according to the actual physical count in the current financial statements, according to periodic inventory system of the company.

Appendix 2

Sale of ICI’s Shares

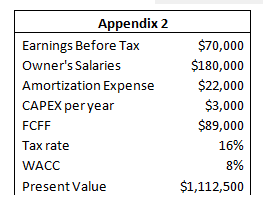

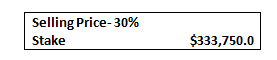

In order to determine the selling price; the amortization expense is added to the earnings before tax and the capital expenditures are subtracted and a free cash flow is determined as $89000 each year. No treatment is done for owner’s salaries, as these are already deducted before arriving at EBT. At a WACC of 8%; the firms’ value is determined as $1,112,500 and 30% of ICI’s stake must be sold to the investor at $333,750.

Appendix 3

Email from Doug on Tax Issues

- Research & Development Expense

The research & development expense amounted to $8400, which is an allowable tax deduction. The company can deduct all of the R&D costs during the fiscal year 2021.

- Other CEI Grant Expenses

These expenses are not related to the company’s operations. Purchase of suits is not a one-time expense in company’s operation. Rather, it’s a personal expense, so it is not tax deductible.

- Insurance Premiums

The insurance premium related to commercial insurance can be deducted from taxable income, as it is considered as a business expense.

- Health Club Memberships

The health club memberships are not allowed as deductions from the taxable income, if the main purpose is recreation, dining or sporting activities. So, the expense of health club membership cannot be deducted.

- Passenger Vehicle Expenses

As the personal car is used for business purposes, so the amount of expenses which are only related to business can be deducted. The mileage, fuel and insurance related to car’s personal usage are not tax deductible, i.e. the expenses need to be apportioned between personal and business related expenses..................

ACCOUNTING Case Study Analysis

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.