Ujjivan: A Microfinance Institution at a Crossroads Case Study Solution

SWOT analysis of the Ujjivan microfinance bank

·Strength

The Ujjivan microfinance has various diversified products such as business loans, educational loans etc. Moreover, the institute is working for the betterment of the country with the objective of eliminating the poverty and empowering women towards their dreams. These objective will also contribute to the economy of the India. As the amount of loans will invest in housing, education and in various business.

·Weakness

The Ujjivan microfinance institute has the lack of qualified staff which will hindered the efficient working of the company. Moreover, the fraudulent activities of the staff will create problem to gain the trust of clients hence, this will leads to the reduction in the number of customers for the bank. Besides, the lack of technology will became the obstacle for the efficient working of the institute.

·Opportunities

The Ujjivan microfinance institute has the opportunities to contribute for the society development by promoting financial inclusion and offers chance to meet the necessities of the underprivileged people. Furthermore, it also contributes in the promotion of different modern technology hence, many other business are dependent on this institute.

·Threats

The Ujjivan microfinance institute has many threats including the threat of competing with its competitors, as the bank has very small share in the market it is difficult to compete with its competitors. Moreover there are also the threat of lack of cash, due to small in market share the company can face the lack of cash to pay to its depositors apart from this, there are various legal requirements and regulations by the government that needs to be followed by the bank. (edition, 2019)

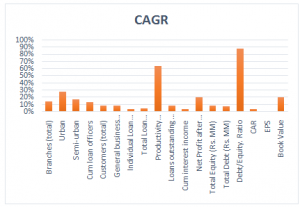

Analysis of financial reports

The Ujjivan microfinance bank has incurred a huge loss in the initiation of the business. This can be indicate by the company income statement of the company. As, the bank is in expansion phase. So, in the current conditions if the company grows by 21% of compound annual growth rate on average, the bank will able to earn profit in subsequent year. Moreover, the earing per share has negative at the initiation of business. If the company grows by the 1% of the compound annual growth rate so, the company will achieve positive earnings per share in the subsequent year, which will leads to breakeven the operational loss incurred by the company.

The performance of the company can determine by the balance sheet. It is assume that the balance sheet items will grow at 7% annual compound growth rate, the total assets of the company are growing as per the assumption. This suggest that only expanding branches is not enough for the company, the company should prepared different budgets in order to reduce the operational loss. Moreover, the company financial statement shows that, the company is highly leverage, on the other hand the company has excessive assets. This shows that the company is not investing in viable ventures. So, to reduce operating loss the company should invest its assets in various capital ventures. In this way the company can achieve the breakeven point and expand in the subsequent year.

Conclusion

The Ujjivan microfinance institute has been expanding its branches in different cities of India including Bangalore, Kolkata etc. for expansion the company needs to concentrate on the reduction in operational expenses by preparing various budget and financial model moreover, the company needs to focus on the employees and their actions that can affect the efficient operations of the company, the company should also focus on to mitigate the risk of default and fraudulent activities conducted in the bank.

Ujjivan is not able to achieve breakeven. However, the expansion will cover the operation loss in the subsequent year. Apart from this the bank should give information to its customers so that, they can adopt the safety measures for the fraudulent activities conducted in the bank.

Recommendations

In order to expand and sustained in the market, the Ujjivan microfinance bank has to develop their technology to mitigate the risk of default as well as, to overcome the fraudulent activities conducted in banks, moreover to reduce operational losses, the company should organize training for their staff and offer dividend stocks to motivate them, the bank should also concentrate in various investment opportunities, to increase the profitability of the bank, and should prepared different budget and financial model to make future decision.

There is higher demand for the loans, if the bank will achieve their targets, they can contribute for the betterment of the economy and will be able to achieve its mission of eradicating the poverty and women empowerment.

Exhibit 1

| 2007 | 2008 | 2009 | 2010 | CAGR | |

| I. SOURCES OF FUNDS 1 Share Holders Funds: | |||||

| Share Capital | 54982000 | 58830740 | 62948892 | 67355314 | 7% |

| Share application Money pending allotment | |||||

| Loan Funds | |||||

| Secured Loans | 58519454 | 62615816 | 66998923 | 71688847 | 7% |

| Unsecured Loans | 3045833 | 3259041 | 3487174 | 3731276 | 7% |

| TOTAL | 116547287 | 124705597 | 133434989 | 142775438 | 7% |

| H. APPLICATION OF FUNDS | |||||

| N. Fixed Assets: | |||||

| (a)Gross Block | 13017398 | 13928616 | 14903619 | 15946872 | 7% |

| (b)Less: Depreciation | 2669925 | 2856820 | 3056797 | 3270773 | 7% |

| (c)Net Block | 10347473 | 11071796 | 11846822 | 12676099 | 7% |

| (d)Capital Work In Progress | |||||

| 10347473 | 11071796 | 11846822 | 12676099 | 7% | |

| Loan (Family & Business) | 84299459 | 90200421 | 96514451 | 103270462 | 7% |

| Current Assets, Loans & Advances | |||||

| Cash and bank Balance | 14360305 | 15365526 | 16441113 | 17591991 | 7% |

| (b) Loans & Advances | 5339769 | 5713553 | 6113502 | 6541447 | 7% |

| 19700074 | 21079079 | 22554615 | 24133438 | 7% | |

| Less: Current liabilities & Provisions | |||||

| Current liabilities | 19607579 | 20980110 | 22448717 | 24020127 | 7% |

| Provisions | 311778 | 333602 | 356955 | 381941 | 7% |

| 19919357 | 21313712 | 22805672 | 24402069 | 7% | |

| Net current assets | -219283 | -234633 | -251057 | -268631 | 7% |

| Debit balance in Profit and loss account | 22119638 | 23668013 | 25324774 | 27097508 | 7% |

| TOTAL | 116547287 | 124705597 | 133434989 | 142775438 | 7% |

Exhibit 2

| Exhibit 1 | ||||||

| Year | CAGR | 2008 | 2009 | 2010 | 2011 | 2012 |

| Branches (total) | 15% | 44 | 110 | 222 | 368 | 562 |

| Urban | 28% | 44 | 79 | 125 | 178 | 240 |

| Semi-urban | 17% | 0 | 31 | 97 | 190 | 322 |

| Cum loan officers | 13% | 331 | 901 | 1883 | 3157 | 4853 |

| Customers (total) | 9% | 78330 | 267340 | 639552 | 1249528 | 2088777 |

| General business customers | 9% | 76290 | 251890 | 597642 | 1166398 | 1948847 |

| Individual Loan customers | 4% | 2040 | 15450 | 41910 | 83130 | 139930 |

| Total Loan Disbursement | 5% | 776542360 | 3376468534 | 9697460727 | 22645914192 | 44941266027 |

| Productivity (cust/loan officer) | 64% | 237 | 297 | 340 | 396 | 430 |

| Loans outstanding (Rs. MM) | 8% | 493 | 1715 | 3998 | 7988 | 13484 |

| Cum interest income | 3% | 56110217 | 302416944 | 965241554 | 2386763050 | 4952587751 |

| Net Profit after Taxes (Rs. M) | 21% | -12331 | 44700 | 168738 | 272450 | 367025 |

| Total Equity (Rs. MM) | 9% | 112 | 661 | 830 | 1120 | 2867 |

| Total Debt (Rs. MM) | 8% | 397 | 1091 | 3348 | 7437 | 12028 |

| Debt/Equity. Ratio | 88% | 4 | 2 | 4 | 7 | 4 |

| CAR | 4% | 0.22 | 37.38 | 19.28 | 11.10 | 19.25 |

| EPS | 1% | -10 | 18 | 68 | 110 | 9922 |

| Book Value | 20% | 91 | 268 | 337 | 454 | 775 |

Exhibit 3

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.