Two ways to fly south: LanAirlines and Southwest Airlines Case Study Solution

Differentiation in services and products:

Key services offered primarily by LAN includes courier, handling and logistics services. LAN provided its services on both local and international hubs providing direct service to its local hubs. Additionally, the cargo services of the airline involves international air carriers, individual customers and freight-forwarding companies. The cargo services were mainly comprised of shipments tracking through internet and warehouses for storage in the region. While, the transportation of products includes vehicles, machines spare parts,computers and cellular phones. Similarly, LAN carried products like vegetables, wine, flowers, fresh fruits, seafood and salmon. Additionally, LAN contracted to the services companies of foreign airports for ground services at a large number of international airports.

Southwest Airlines services involves point-to-point, low fare service which has known to serve 374 nonstop pairs of city restricted in United States only as well as freight and other services.Under the business of Cargo management, it offers variable services which includes the service of RUSH Priority, the Next Flight Guaranteed, with a promised maximum delivery time of 48 hours or 100 percent refund. Additionally, the service of US Postal split its mail among a freight carrier and commercial combination. Other than that, Southwest was also engaged in a number of programs such as visa card by a company sponsored Chase Bank.

Comparison of common denominators:

Comparison of Denominators

A comparison of various financial and operational denominators could be used to analyse that whether Lan could expand towards Texas and Southwest could expand towards South America or not? Both of the denominators provide the information regarding the organizations’ abilities to and willingness to move towards these potential markets.

Financial Denominators

The financial denominators that could be used for the analysis includes various liquidity, solvency and profitability ratios that are given in the following Table 1.

First of all, it could be seen from the above table that the Southwest has most of its ratios higher than the Lan which implies that the Southwest is comparative more financially strong than Lan. Both of the organizations have low debt ratio which implies that both can raise potential funds that are require do expand into the international regions. Moreover, the ROA and ROE of both of the organizations is reasonable to justify the success of the organizations in utilizing their assets. However, both of the organizations have a low current ratio which implies that both of the organizations could face a severe liquidity issues and problems in repaying the debt acquired for the expansion, if they decide to move towards further international markets. Therefore, on the basis of the financial denominators, it could be said that neither Lan nor the Southwest could move towards Texas and South America respectively.

Operational Denominators

The operational denominators that could be used to analyze the ability to move towards international markets include the statistics regarding the Available Seats Miles (ASMs), Revenue Passenger Miles (RPMs) and Passengers given in the Exhibit 2 A of the case. It could be seen from the Exhibit 2 A that the Texas has high approach towards international markets with high number of International ASMs, RPMs and the passengers, which implies that the company could easily expand its operations towards Texas and could earn more revenues than its domestic markets. However, the Southwest have no international experience with no international passengers and ASMs, which implies that the company would require high amount of investment to move towards South America and would face high chances of failure with no historic experience and poor liquidity position.

On the basis of statistics of LAN and Southwest, to answer whether the land of Southwest in South America i.e. international market and further expansion of LAN in United States would be beneficial can consider Exhibit 2 A of the case. As it clearly demonstrate through the data of the year till 2005 in comparison to that of an average rate of both Southwest and LAN.

Recommendations:

In consideration with the financial analysis of both the LAN and Southwest, as both the organizations operating in different regions had been performing well. But, as the services of Southwest services were only limited to its domestic regions whereas LAN had been successfully involved in the international services with more statistics in comparison to average value evaluation. With the fact that, the number of services and products provided by LAN in comparison to Southwest to its competitors are more prominent with effective use of technological and strategic approach.

Therefore, considering liquidity and financial ratios of both the corporations, according to the operational denominators, the organization who somehow has the potential to work in Texas is LAN. But it requires additional investment for further expansion of business. So, the organization should first improve its liquidity then move towards Texas for its operational services.

Conclusion:

Conclusively, in analysis of which corporation has the potentially for maximizing its effectiveness in Texas.Considering Southwest Airlines and LAN Airlines management and operations, the key reasons behind their competitive approach and increased profitability includes a number of factors such as fare rates, service quality, transportation etc. As the Southwest have no international experience with no international passengers and ASMs, which implies that the company would require high amount of investment to move towards South America and would face high chances of failure with no historic experience and poor liquidity position.Therefore, LAN somehow has the potential to work in Texas.

Exhibits

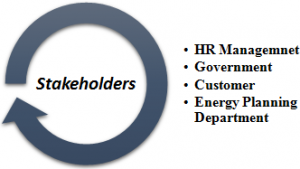

Exhibit A – Stakeholder Analysis:

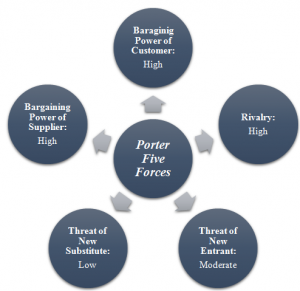

Exhibit B – Porter Five Forces Analysis:

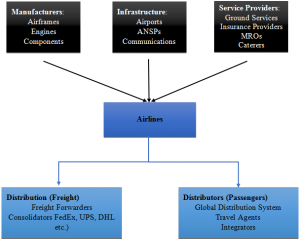

Exhibit C – Commercial Value Chain Analysis:

Exhibit D – Financial Denominators

| Comparison of Financial Ratios | ||

| Lan | SW | |

| Current Ratio | 0.85 | 0.94 |

| Debt Ratio | 24% | 10% |

| ROE | 29% | 8% |

| ROA | 7% | 4% |

| Gross Profit Margin | 6% | 11% |

| Net Profit Margin | 6% | 7% |

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.

How We Work?

Just email us your case materials and instructions to order@thecasesolutions.com and confirm your order by making the payment here