The Budda-Bing Manufacturing Company Current Financial Position Analysis Case Study Solution

Evaluation of the “Firm’s Profitability Ratio”

Lastly, the evaluation of the firm’s current year is based on its profitability ratio by using two different viewpoints cross-sectional and time-series. Under the calculation of profitability ratio,there isa total of four ratios are calculated for the firm, which are (gross margin, profit margin, ROA, and ROE)(Husain, 2020). According to the cross-sectional evaluation,the gross margin and profit margin of the firm’s current year 2020 are about (27.0% and 1.0% respectively), which present that the gross margin of the firm is slightly higher as compared to the actual average industry ratio of the year 2020 but the profit margin of the organization is faintly lower than the industry average.

It means that the organizationconsiders profitability in its workings and considersthe potential in the industry because of its positive margins. The ratio of ROA and ROE of the actual average industry is about (2.4% and 3.2% respectively), which is considered to be less than compared to the current year of the firm which is (6.2% ROA and 4.2% ROE). The overall ratios of the profitability present that the firm hasa high potential of generating profitability.

To look over the time-series evaluation the previous year of the firm 2018 considers (27.5% gross margin, 1.1% profit margin, 1.7% of ROA, and 3.1% of ROE) and in the year 2019 the firm present (28.0% gross margin, 1.0% profit margin, 1.5% of ROA, and 3.3% of ROE). These results present that the firm improves its progress as compared to the previous year because it considers approx. same gross margin in all three years and the firm also increase its ROA very high as compared to the previous year.

Overall “Evaluation of the Firm’s Current Position”

The overall analysis of the firm’s based on four different ratios (Liquidity, Activity, Leverage, and Profitability ratio). The firm is evaluated on these ratios based, which present the current standing of the firm as compared to the current year 2020 actual average industry and a comparison with its previous year calculations. These calculations present that the firm hassustainable and favorable liquidity and activity ratio in comparison with both the industry and its previous year. The Leverage ratio of the firm is considered to be very high, which is directly considered to be a high-risk level but on another hand, the firm hasa high level of profitability in its overall profitability ratio. However, the firm has favorable profitability ratios that help them to attract investors and creditors.

Part (B)

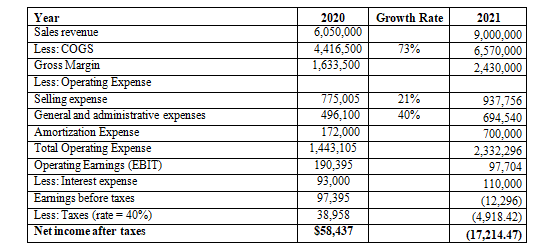

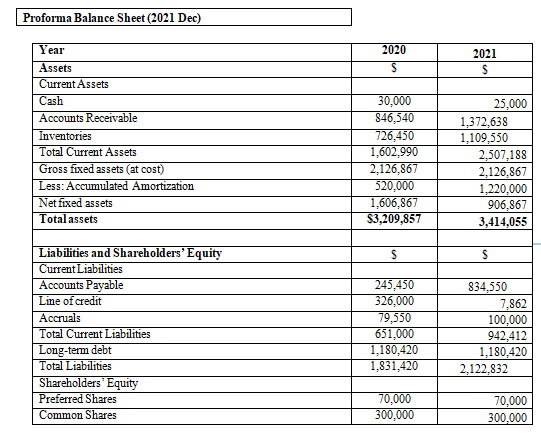

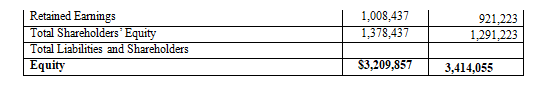

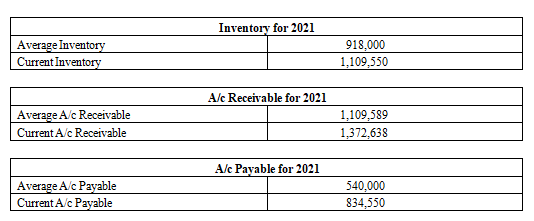

Pro Forma (Income Statement and Balance Sheet) (Dec 2021): Part (a)

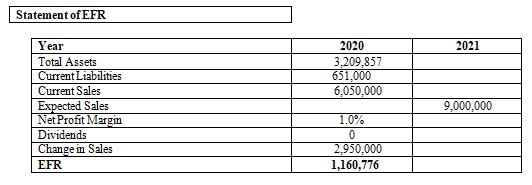

Statement of EFR: Part (b)

The external funding required for the next year pro forma under its financial statements is about ($ 1,160,776). This value presents that Budda-Bing manufacturing needs external financing for its new facility construction because the cost implemented in 2021 for the new facility is about ($ 600,000), which present that organization has to raise the amount of cash in the coming year's financial statements.

EFR is calculated by using the current year's total assets, current liabilities, sales of the current year, profit margin, the dividend paid in the current year, and the last expected sales of the projected year(Gralha, 2018). To calculate the change in sales subtracts expected sales from the current sales. The overall calculation is done by using the EFR formula.

Recommendation for Raising Financing (Budda-Bing Manufacturing): Part (c)

Raising the Financing

The current calculations give an insight into the financial condition of the firm which reveals that the debt ratio of the firm is around 57%. This means the company has taken a loan of 57% in starting the business. The remaining 43% was provided by the firm itself. This depicts that the company is not in a condition of taking further loans as they are already buried under a giant debt of 57%. This accounts for two options best suited to overcome the current situation.

The first option that can be adopted is equity. It is the ownership of assets that the firm is holding. This means that the firm can utilize its current finances and resources to aid the finances without depending on external factors or joint ventures. The firm can approach venture capital to aid in funding(Lerner, 2020). These firms are directed toward funding small businesses which can prove beneficial. Since Budda-Bing has promising long-term growth potential, venture capitalists might tend to accept the offer.

Available Options for Financing Opportunities

There are many opportunities on the way to financial upheaval but four major opportunities are the best to be considered.

Long term debt

The firm is under a debt of nearly 57% which makes it inconvenient to take further loans but a long-term loan plan can help the firm in overcoming current problems and establishing its goals. The company's financial increment can help pay the debts later on. This can be a promising step if analyzed carefully.

Capital Venture

As already mentioned, venture capitalists are organizations that aid small firms to establish themselves in markets. They fund them financially and thus help them grow. These first analyze the potential of a firm to grow in the market and then accept their requests. As Budda-Bing is a profitable firm there are chances that these venture capitalists can accept their funding request.

Common stocks

Common stocks can be a beneficial way as well. The increase in the issue of common stock can help the firm in increasing assets which might prove beneficial. The company can sell these assets whenever there is a need for competitive market prices and thus gain a promising profit base.

Preferred stocks

Similar to common stocks, preferred stocks can also prove beneficial. These can be increased and when sold in the market, may prove a beneficial return. It requires an in-depth analysis of the current stock exchange market in gaining the asset to the side of the beneficiary rather than indulging in further losses.......................

The Budda-Bing Manufacturing Company Current Financial Position Analysis Case Study Solution

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.