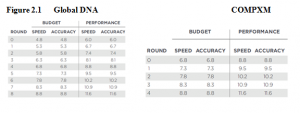

Budget Allocation:

As Andrews had four products, the biggest challenge was an allocation of budget in marketing towards sales and promotions for all the products. The customer satisfaction index, Awareness, and Accessibility were dependent on this, which directly had an effect on product sales.

In the budget segment, our products Able and Ablaze sold really well. In the last round, our products held the second and fourth spot in terms of sales in the USA and Europe and the second and third spot in Asia. In the performance segment, our product Agile topped sales in USA and Asia in the last round and came a close second in Europe. Ace came third in all regions in the last round. The reason for BALDWIN to make a better cumulative profit is that they had a much higher automation in all rounds with a value of 9 in the last round but our automation value was 6.5. Andrews made the most profit in the last round but the company was not consistent in all the rounds of the competition.

Andrews was quite successful when it comes to implementing our company’s strategy especially because the company was improving their position as the rounds progressed almost beating BALDWIN in the final round. If Andrews had better forecasts and took bigger risks, the company would have emerged as winners of the competition.

- A strategy based on differences between Global DNA and COMPXM

The positioning of the product specifications:

As you can see in the below figure, the product specification requirement for the budget and performance segments in COMPXM starts at a higher position in comparison to GlobalDNA. COMPXM Round 0 corresponds to Round 4 of GlobalDNA in terms of target product specifications. In the Globe, the specifications of each product in Round 0 in COMPXM are different right from the start. Andrews would need to plan strategies as they are in the middle of the competition instead of looking at it as the first

Segment sizes:

The market segment sizes are smaller for Americas and bigger for Europe and Asia in the COMPXM, which will make us give more importance to Europe and Asian markets since the beginning of the competition.

Market Growth:

When you compare the market growth between GlobalDNA and COMPXM, markets grow at a slower rate in COMPXM, which makes it easier to invest on automation and at the same time catch up with the growing plant capacity. However, this will be also utilized by our competitors and hence not really an advantage.

Buying Criteria for Budget:

The price is having lesser importance in COMPXM than Global DNA. For Europe and Asia, the second most important factor changed from age to ideal position while for Asia it changed to service life. It will be interesting to find a balance while designing specs in R&D, as they are common for all regions.

Buying Criteria for Performance:

The ideal position is having lesser importance in COMPXM than GlobalDNA. For Europe and Asia, the second most important factor age is now having lesser importance while for Asia it has changed to service life.

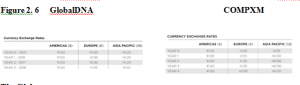

Figure 2. 5

In Europe, the dollar is stronger for first three rounds and weaker in the last round in COMPXM in comparison to GlobaDNA. In Asia, the dollar is weaker in COMPXM than in GlobalDNA.

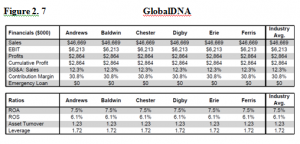

The Globe

Team Positions:

Teams started at the same positions from different positions in COMPXM. BALDWIN having the best position in terms of cumulative profit. In Asia, Andrews did not make a profit as the sales were less in comparison and it is less than the investment made. Able sells more than Daze in Europe due to higher customer satisfaction. This is because Able’s specs and service life are better than that of Daze.

Manager’s Guide

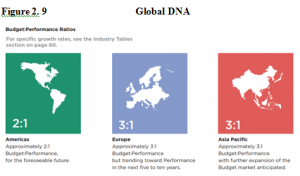

Budget to Performance Ratio:

There is a much lesser difference in the ratio of budget to Performance segments in COMPXM in comparison to GlobalDNA, which means that the Performance sector has more importance in COMPXM than in GlobalDNA.

Figure 2. 10 COMPXM

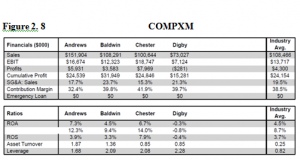

Automation:

Automation started at 3.0 for all teams in GlobalDNA but the values are different for all teams in COMPXM. Andrews starts at 4.5 while other teams such as Chester and Digby starts at 6.5 and 6 respectively. This is a major disadvantage because our labor costs will be higher than competitors starting from the first round in the competition. Hence, the company would need to invest in automation to catch up with the other teams.

As per the above analysis and comparisons, COMPXM gives more priority to the performance segment in comparison to GlobalDNA, Andrews has lesser automation in comparison to other teams and the company starts at the third position instead of an equal start in GlobalDNA.

The strategies of competitors are also very different in COMPXM and GlobalDNA. In COMPXM, Andrews will have to make decisions alone against the software that manages other teams while in GlobalDNA, Andrews competed against other teams which were also managed by a team of students. In COMPXM, Chester covers only the budget segment, which makes them a Global Niche Cost Leader. Another company with a Niche strategy is Baldwin. Baldwin sells their products only for the performance segment, which makes them a Global Niche Differentiator. An interesting fact about market penetration is that Chester has not entered Europe while Daze has not entered the Asian market. This makes it much more difficult to compete, as Andrews cannot make the correct predictions expecting them to enter the region in any round.

- Strategy in COMPXM

The Strategy planned by Andrews in COMPXM is that of a fusion between Global Broad Differentiator and Cost Leader. The idea behind the strategy is to enter into all segments and regions with good specs but at the same time reduce the costs considering he contribution margin, exchange rates and profit forecasts.............

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.