Saxon Financial Case Solution

Answer of Question 6

After thoroughly analysing the companies; it can be said that pursuing the acquisition would be a good decision and it will provide the company with growth opportunity and an increased economical scope. The company’s valuation was calculated by using various effective analyses, and following are the crux of those various analyses:

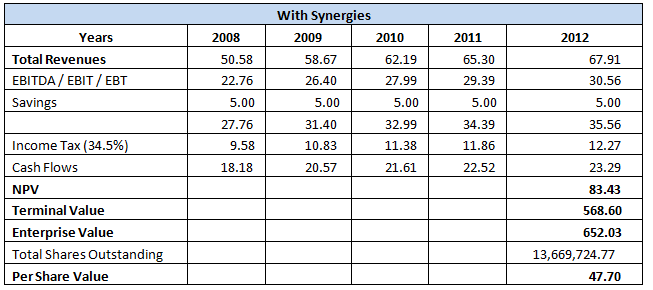

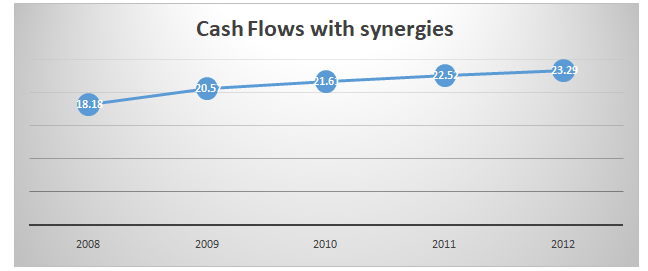

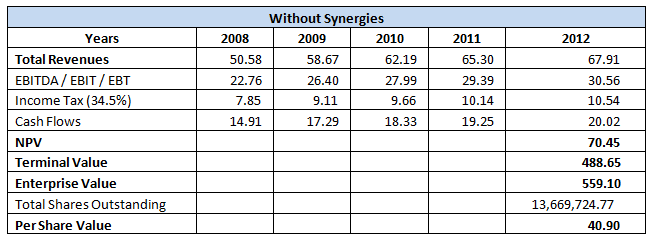

- Using discounted cash flow (DCF) analysis, it was determined that the price per share would show an increasing trend in case of synergies.

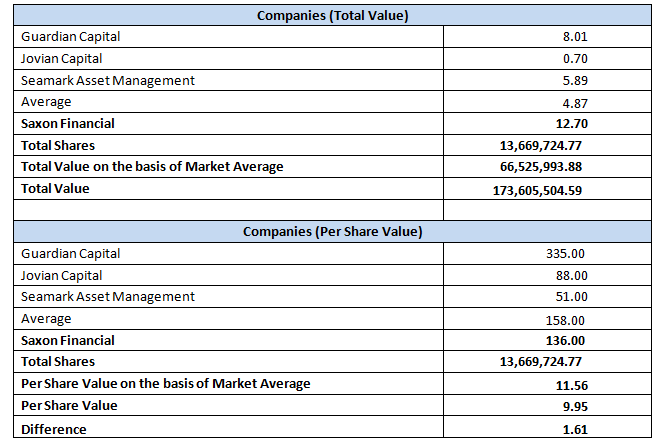

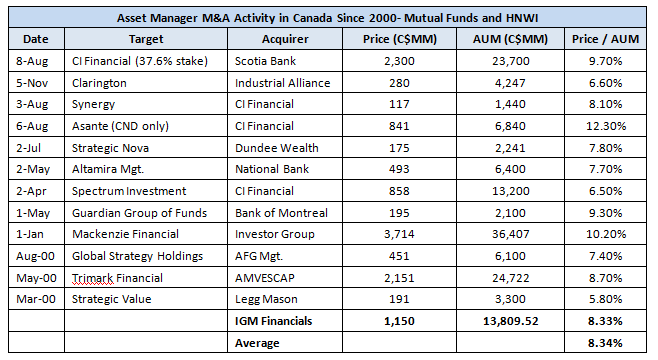

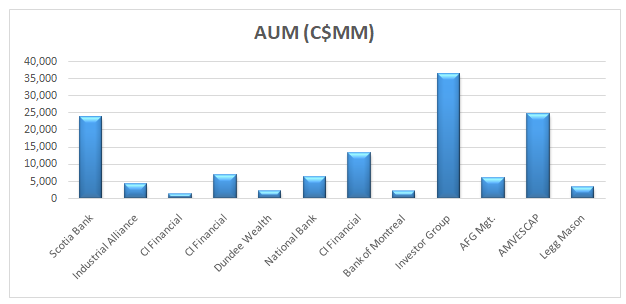

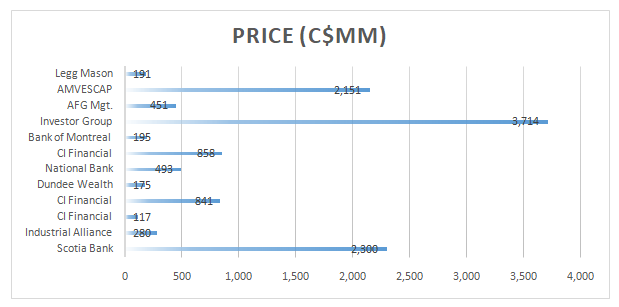

- Then the company was valued based on Precedenttransaction and comparablecompany analysis.

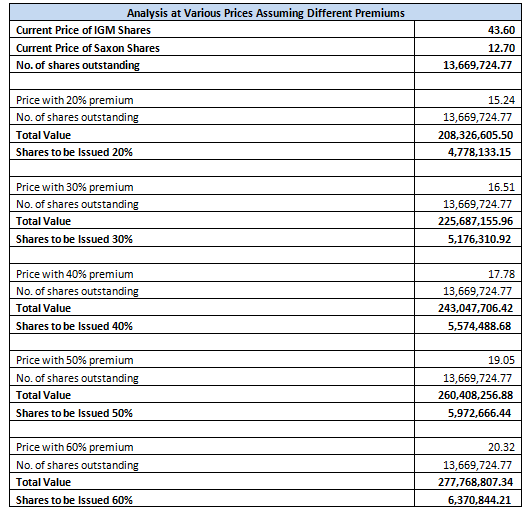

- It was also analysed that using 20% to 30% of premium would work for an effective acquisition.

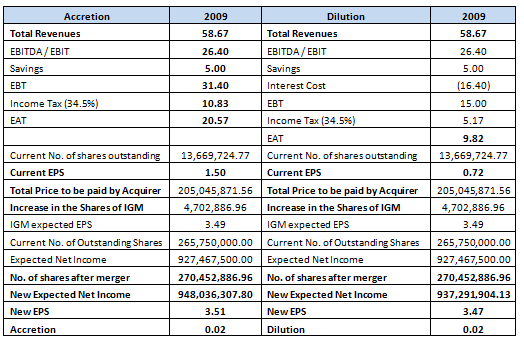

- By opting for all stock deals; IGM would be able to increase Saxon’s earning per share.

- For effective stock value; the average value resulting out of all three methods must be considered, i.e. the new value of stock must be in the range of $20 to $40.

Exhibits

Exhibit 1

Exhibit 2

Exhibit 3

Exhibit 4

Exhibit 5

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.