Moly Corp Financing the Production of Rare Earth Minerals

Introduction:

Moly Corp is one of the best mining corporations in the world. It is the corporation of America the headquarters are located in Greenwich. This company mine valuable minerals from the soil and this company produces non-polluted minerals from the soil. In the year 1949, Moly Corp discovered metallic life in the soil. In the year 2011, the company announced that they earn more revenue from mining sales(Mayfield, 2015). This project aimed to generate 20,000 tons of Erratic Earth oxides for the coming 30 years.

Problem statement:

Moly Corp is facing a financial collapse and a fall in market shares.

Risk:

One of the major risks for Moly Corp Financing the Production of Rare Earth Minerals is a change in government guidelines regarding rare earth mineral production. The latest advancements in the market may boost the company's performance by having a rapid shift in technology.

Financial Analysis

Leverage ratio:

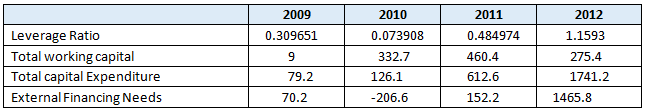

The company has a low leverage ratio in 2009 in this year company has a low debt with high equity. The leverage ratio is increasing from 2009 to 2012 which is not good for the company. Ratio increases from o.30 to 1.15 as shown in the following table.

Moly Corp is not at the optimal leverage ratio.

Total Working Capital:

The value of total working capital also increases because in mining projects the company uses to take a loan from China and a bank.

Total capital expenditure:

Total capital expenditure increases for this project. In the year 2012, the value of expenditure is $1714.2 million.

External financing Needs

The external financing need for a company that forecasts in 2012 is $1465.8 million from which the company pays the shareholders and bank.

Elements of Business Plans:

The purpose of this financing approach is for management to effectively raise enough capital to outlast their existing credit status and pay near-term creditors with as little dilution to current shareholders as possible. The company is exploring three different financing alternatives to support Project Phoenix: direct debt in the form of bonds, convertible debt, or issuing ordinary stock.

Straight Debt

Raising pure debt would be the least dilutive to present shareholders, but with Five-Year notes with a 10% semi-annual coupon and a face value of $1000, it would be an expensive raise. They'd sell for $950 per bond, have a CCC rating, and tight legal provisions to safeguard the creditor.

In terms of straight debt valuation, we assume a growth rate of 1.4 percent, a tax rate of 35 percent, and cash flows estimated from future financial statements. The weighted average cost of capital (WACC) is 14.32 percent. This information is used to calculate the enterprise value, which is $2086.036 million. Finally, we subtracted debt from cash to arrive at the entire worth of equity, which is $1620.336 million. The price per share is $14.747, with 109.9 million shares outstanding.

Convertible Debt

By issuing convertible debt, CEO Mark Smith will form a partnership with an activist investor who believes in the company's and industries long-term viability. The five-year notes would be issued on par ($1000) with a 6% coupon and semi-annual interest. The shares would convert at a rate of 72.464 shares for every $1,000 invested, or $13.80 per share.

We estimate the cash flows from the future financial statements and assume a growth rate of 1.4 percent and a tax rate of 35 percent for the convertible debt valuation. The weighted average cost of capital (WACC) is 13.45 percent. This information is used to calculate the enterprise value, which is $2288.918 million. Finally, we removed debt from cash to arrive at the entire worth of equity, which is $1823.218 million.

Common Stock

Issuing common stock would dilute present shareholders and draw more unfavorable attention from analysts and current shareholders to the company. If Moly Corp wants to raise money by selling stock, it must first issue warrants.

When calculating the value of a common stock, we assume a growth rate of 1.4 percent, a tax rate of 35 percent, and cash flows based on predicted financial statements. The weighted average cost of capital (WACC) is 13.20 percent. This information is used to calculate the enterprise value, which is $2353.515 million. Finally, we added cash and subtracted debt to arrive at $1887.815 million in total value of equity. The price per share is $13.484, with 140 million shares. This choice will cause a higher equity value for Moly Corp.

External Financing Needs

Project Phoenix required 314 million in capital expenditures from July 2012 to the beginning of 2013, with 289 million spent in 2012 and 25 million spent in 2013. In addition, the firm had to spend 45 million on accrued expenses and payables. As part of an acquisition, the corporation had to redeem 230 million in convertible debt and repay 33.2 million in other liabilities. As a result, the total cash required for a 7-month operational runway is 622.2 million (289 + 25 + 45 + 230 + 33.2). The corporation has 369 million in cash, I budget of which 75 million for day-to-day operations (369-75 = 294). As a result, Moly Corp's total external funding requirement for the second half of 2012 and the first half of 2013 is at least 328.2 million.

Conclusion:

Moly Corp is the biggest manufacturer of Intermittent Earth mineral and this database is a major capital expenditure which is also known as the Phoenix program or CAPEX program. This program was aimed to renovate and increase the mountain pass mine which was located in the city of California. In the initial phase, this project faced so many difficulties. The major problem faced by the corporation was that the prices becomes low for about 85% of all earth minerals. And the other problem was the company going down in the share market. The shares of the company decreased to 16 dollars from the range of 77 dollars. Again the prices decrease from 16 dollars to 11.8 dollars approximately. The drop in both stock prices and minerals shows a weighty change in its long-term projections.

Invest in Moly Corp or not?

For this project, the Moly Corporation needs $569million for financing. Moly Corp has failed in this project and most of the investors are not ready to invest in the company. The prices become out of control and the revenue declines so we should not invest in Moly Corp.

Recommendations:

An alternate method of raising project funding is recommended instead of selling the stocks. Based on the free cash flow forecast, the project is financially viable, as it will create revenue and profit margins. Rather than selling preferred stock or issuing preferred stock to the public, an alternative means of raising project funding is advised. Because of the company's considerable sales and profitability, I expect the stock price to rise soon. A significant increase in the company's revenues and profitability will improve investor trust in the company. In compared to comparable rare earth mining companies, the company's debt-to-equity ratio is 47 percent, which is much higher than the industry average of 0 percent. I have given the company a credit rating of "CCC."....

Moly Corp Financing the Production of Rare Earth Minerals

sample partial case solution. Please place the order on the website to order your own originally done case solution."}" data-sheets-userformat="{"2":14913,"3":{"1":0},"9":0,"12":0,"14":{"1":2,"2":3355443},"15":"Arial","16":10}">This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.