J. P. Morgan Report Section 4 and 5 Case Study Solution

Products (funding, investment and services)

The funding includes credits, deposits and secularization; whereas, the investment and services include: service management, issuance, securities and credits. Through providing the value added and diverse range of products and services; the companies in the market attempt to attract a wider base of customers.

Secondary activities

Technology development

In the financial service industry; the investment in the technology helps a company in gaining competitive advantage over the industry peers in the market. The technology development helps in improving the company’s productivity and its efficiency in delivering the products and services to its clients. Furthermore, the digital technology has driven the convenience of customers in the overall banking industry.

Human resource

Despite of a growing part of the technology development;the human resource continues playing an inevitable part in the banking industry. The significance of the human resource is followed by the trust in the banking environment, internationally.

Infrastructure

From physical infrastructure to the information technology;infrastructure plays an effective role in the functioning and growth of the banks. Because of the robust and intense competition in the banking industry; the significance of the information technology has continued growing overtime. With an increasing risk related to the privacy and data security; the banks are now focusing more on maintaining an impenetrable and strong IT infrastructure.

Company Value Chain:

The value chain activities are those activities, which add values to the services offered by the company. A value chain is considered the set of interrelated activities, used to create the competitive advantage. The value creating activities of the company falls into two main categories, which include: support activities and primary activities. The primary activities of the company include marketing and sales, customer service as well as a number of services, such as: investment banking, commercial banking, private banking and treasury and securities services, human resource management and asset management.

On the other hand, the company’s support activities are composed of risk management, through which the company creates economic value by using financial instruments to manage the exposure to risk,specifically market risk and credit risk. Another support activity of the company includes distribution channels, i.e. website through which it provides information and valuable insights on the products and services to its customers. The company also offers mobile banking and internet services to the customers and it serves international clients through subsidiary foreign banks&representative offices, overseas subsidiaries and branches.

Furthermore, the other support activities included in the value chain of the company, are discussed below:

Training program

The sales force of the company is the best marketing assets. The company increases the value of its business by increasing its sales staff's effectiveness by implementing training programs that promote communication between them and the customers. The relationship between sales person and the customer continues to build and grow, leading towards a greater loyalty and repetitive business. As sales team grows and becomes effective;the company could witness an increased productivity as well as reduced costs. A Value Chain can be used to create a solid foundation for the business and to ensure the continued success. By establishing a solid relationship with the customers;the company has maintain-edits current position in the market and has become an increasingly respected presence.

Procurement operations

The JP Morgan Chase Company is engaged in implementing the category management approach to procurement and sourcing, which means that the company’s sourcing team is aligned to discrete groups of related or similar products or services. Additionally, the company has built strong relationship with its suppliers, which is the cornerstone of the JP Morgan’s success. The company has also launched Supplier Diversity Network, which offers diverse suppliers with an access to the information sessions on procurement strategies, commodity-specific in-house trade shows/matchmakers (both virtual& physical), networking receptions with prime suppliers&buyers and business management referrals, workshops and seminars to the financial services.(Officials, 2019).

Artificial Intelligence

The company is leading the way in artificial intelligence enabled banking services, with a comprehensive strategy that tends to span across the functions and business lines to create value for the company, industry and its clients. The extensive evaluation of the client communication across various channels, allows the company to provide customized product recommendations and better customer services. The chat box and virtual assistants are used in order to reduce the responding delay to the employees’ request as well as of clients, thus improving the operational efficiency and client service.(Officials, Robo-Banking: Artificial Intelligence at JP-Morgan Chase, 2020).

Integrate the logistics management with the financial service

The JP Morgan Chase & Co. is the only financial service provider which has integrated the trade logistics services with its financing solutions. The purpose of integrating the logistics management with the financial service is to help corporate the clients by ensure that they are compliant with the custom regulations of the international countries. Additionally, the company ensures of the supply chain performance, seamless custom compliance, global visibility & documentation fulfillment.(Reporter, 2013 ).

Border logistics management solutions

Furthermore, the company has launched new border logistics management solution, which is the comprehensive outsourced custom warehousing service that has been designed to bring a greater efficiency and visibility to the firms that move goods between Mexico and the US. With the introduction of the border logistics management solutions;JP Morgan is able to help other companies in improving their working capital, saving their time as well as enabling them to take greater control of their supply chain by improving their security and regulatory measures, decreasing order to deliver time, reducing the levels of inventory and improving the monitoring of carrier activities.(Dulles, 2007).

Infrastructure

The Infrastructure Finance and Advisory group of the company has the international mandate to provide valuable advice to clients on financing the infrastructure projects. By leveraging expertise across markets, sectors and products; the Infrastructure Finance and Advisory group customize and integrate solutions and offer to help clients in meeting their financial, strategic and risk management objectives.

Core and/or Distinctive Competencies:

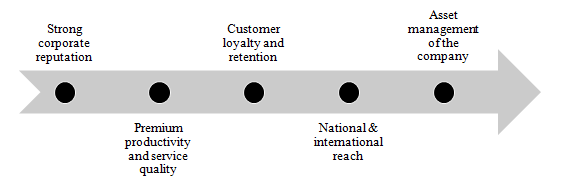

JP Morgan is known for its strong corporate reputation in the industry, which enables it to give clients confidence in their financial capacity. It provides solutions for all types of financial problems, including: loans, investments and corporate loans. It also offers its clients an easy to use website for all their needs.The premium productivity and service quality is of high importance when operating in the financial service industry to achieve the competitive edge over the market competitors. A satisfaction level of client or customer is dependent on the customer’s trust on the service provider and perception of service quality and productivity. By providing customers high quality services;JP Morgan revives the customer’sperception regarding productivity and service quality.

Specifically, in the banking industry; the premium service quality and productivity play a significant parts for the customers in evaluation of the service provider performance & it is a key to build long term customer relation and to gain the customers’ loyalty and their satisfaction.

Additionally, the service quality and productivity is prime aspect of the premium customer experience. JP Morgan consistently monitors its services in order to improve its customer loyalty and retention and to make sure of maximum customer satisfaction. JP Morgan builds positive customer experience by satisfying them through properly meeting the customers’ expectations, demands and offering them those products and services that are up to the market standards.An improved service quality and an excellent productivity help the company in developing an attitudinal loyalty that is perquisite for the customers’ retention.

Moreover, the core competencies of the company are listed below:

- The company’s reliability and its quality service have helped it in establishing itself as one of the prestigious, most well respected and largest banking institutions around the world. The company has track record for providing reliable and high quality products to the customers, across its four operating segments.

- The international reach of the accompanying the broad spectrum of the customers all across the Middle East, Africa, Asia, America and Europe.

- The company’s asset management serves high net worth individuals and large institutions & retail investors in the major global markets.

Competitive Advantage:

JP Morgan is arguably one of the most dominant financial institutions in the United States. The bank’s combination of sound risk management, diversification and scale seems like a simple path to the competitive advantage. This “best in class” financial institution has the strong balance sheet to survive the Covid19-driven economic crises and it is well positioned to expand the market share as the economy of the country recovers. JP Morgan with its strong balance sheet, industry leading profitability as well as its undervalued stock tend to present another excellent buying opportunity for the potential investors who are willing to look beyond the current global pandemic.

The company has the strong history of growing profit returns over the period of time. Over the period of last five years; the company has successfully grown its revenues by 7 percent compounded annually. Since the year 2009; the company has grown core earnings by 10 percent compounded on annual basis. It has also increased its core earnings margins over the past 10 years, i.e. from less than 11 percent in 2009 to 23 percent TTM.

The improved profitability of the company helps the business in generating significant free cash flows. Overtime,the company has successfully generated positive free cash flows in each of the prior 10 years as well as 39 percent of the market capitalization over the period of last five years.

Hence, the main competitive advantages of the company is its strong balance sheet, as half of the company’s net revenues come from the non interest revenue sources and superior performance as compared to its market competitors.(Trainer, 2020).

In addition to this, the superior profitability of the company in comparison to its market competitors, can be measured by analyzing the following table:

| Company | Ticker | Invested capital returns | NOPAT margins | ROIC |

| JP Morgan Chase & Company | JPM | 0.46 | 25% | 12% |

| Bank of America Corp | BAC | 0.34 | 27% | 9% |

| Wells Fargo & Company | WFC | 0.42 | 18% | 7% |

| Citigroup Inc. | C | 0.31 | 20% | 6% |

The rising invested capital and high margins have turned the leading return on invested capital of the company. The current ROIC of the company, i.e. 12 percent, is greater as compared to the banking peers and above the 7 percent was earned at the depth of the economic downturn in the year 2008.

Furthermore, the company has successfully maintained an excellent credit quality for a number of years, invested billion in compliance and innovation and technology and has built its deposit base in order to stay ahead of the market competitors and has remained in the good graces of the regulators as well as the customers. The key strategic moves of the company provides it with competitive advantage in the highly competitive market arena. Moreover, the company is continuously increasing its share in the key segments as well as is investing billions in technology for its future ahead. Thus, the stewardship of the company’s shareholders capital is indisputably among the best in the banking industry.(Compton, 2020).

The company keeps well balanced portfolio with core consideration over making the firm risk adverse. Furthermore, the diversified revenue streams most likely provide income visibility to the company across the economic and business cycles.

Section 5: Strategies

Business Level Strategies:

The business level strategy of the company is based on building up loyalty and trust amongst customers, develop brand identity and focus on differentiation. Additionally, the company is engaged in maintaining & strengthening its leadership position in the market to improve customer satisfaction and gain market share.

To be precised; JP Morgan provides a broad range of banking and financial services to its customers. JP Morgan is stronger with its effective and straight forward business model, which is to deliver long term value to its shareholders.

The company has been looking after its clients and the businesses that it serves. The company also has a set of leading capabilities in the operating areas. This is one of the strength and power of the company’s business model that leverages the short term as well as the long term benefits. Additionally, the company also makes sure to optimize its balance sheet in order to efficiently perform with the post crises regulations. The business model of the company depends on several strategic objectives, which are as follows:

Corporate Level Strategies:

One of the most important aspects in a corporate-level strategy of JP Morgan, is its ability to provide an efficient service to its customers. With this in mind; the bank has created branches all over the world, which offer services that clients would need............................

J. P. Morgan Report Section 4 and 5 Case Study Solution

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.