Pessimistic Scenario

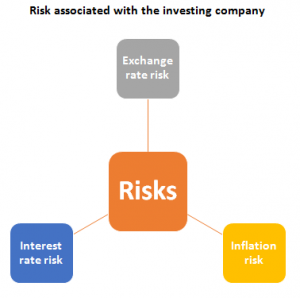

In pessimistic scenario, the economic conditions are considered to be less favorable for investment in both the companies located in different countries.In the pessimistic scenario the exchange rate, interest rate and inflation rate will appear to be less favorable for Big S regarding investing in both the companies. Hence, the increase in interest rate is considered less favorable for Big S to invest in either of the company because increase in interest rate is the step taken by the government’s monetary policy to decrease the inflation. Moreover, the increase in interest rate could also result in depreciation of the currency, because if the inflation rate also increases with the increase in interest rate then it will affect the exchange rate of the country i.e. the country’s currency will be depreciated due to the unfavorable condition i.e. increase in interest rate and inflation.

In unfavorable condition, the investment in option B will be more reliable for Big S than investment in option A, as Placard is located in the United Kingdom, which seems to be more stable regarding the country of option A, due to the stable political and economic situation prevailing within the country. Hence, if interest rate, exchange rate and inflation rate appear to be against the investment by Big S, the loss or decline in profitability ratio will be less severe for the investor company i.e. Big S (Guangzhong Li, 2016).

Risk Associated with the Investment in Option A and Option B

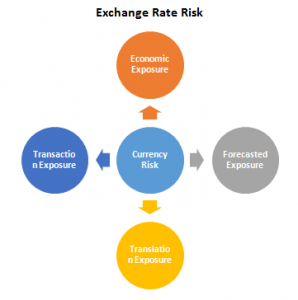

The exchange rate risk is high whereas the interest rate risk is low for Big S if it chooses to invest in Birdies, which is located in Country A. As the Country A is heavily dependent on oil and the interest rate of that particular country is also high, which indicates that the chances of currency depreciation by investing in option A is high in comparison with the option B. Placard which is located in the United Kingdom seems to be more stable because of low interest rate and low inflation prevailing within the country,which is also a sign of currency appreciation and sounds economically stable. Hence, the exchange rate risk is a major risk, if Big S Company chooses to invest in country A.

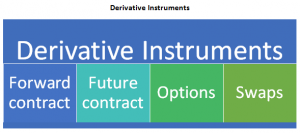

The financial derivatives instrument which can be used by Big S Company to protect itself from the risk which are involved by investing in the foreign companies is the hedging contract in sales and purchase of goods and raw materials. The hedging contract regarding the exchange rate risk of the company will enable the company to fix the dollar amount of payment or receivable to the date when the order is executed(Shawkat Hammoudeh, 2013). This type of hedging instrument will fix the amount,and if the currency appreciates or depreciates, its effect will not result in the exchange rate loss or gain due to the hedging instrument used by the seller or buyer to protect himself from exchange rate risk. Hence, these derivatives includes future, forward option and calls which will assist the parties in saving themselves from risk exposure they are experiencing.(Shawk at Hammoudeh, 2013). Therefore, future contract is the most reliable hedging instrument that can be used by the company to lock the prices in the future once the agreement is signed between both the parties.

Conclusion and Recommendation

After conducting thorough analysis on both the options, it is analyzed that the company should invest in Birdies which is located in country A i.e. option A. The reason of which is that standard deviation of option A is lower as compared to option B and increase in ROI by investing in option A is also greater than option B. Moreover, the company’s steps toward monetary policy is to reduce inflation which will be beneficial for the company as the reduction in inflation can result in the appreciation of the currency. Hence, investing in Birdies will provide an exposure to different markets with low cost of production, which will also assist the company to compete in New Zealand by acquiring cheaper part from Birdies which will reduce the company’s cost of production.

Appendix

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.