Finance Project Study Case Solution

There are less publically traded companies in U.S as compared to prior years. According to the analysis, from last 20 years, U.S had lost almost 50% of publically traded companies. Publically traded firms declined from 6797 in 1997 to 3485 in 2013. The reason for the decline was the decrease in some IPOs as well as the higher rate of M&A activity about some public companies. Another reason for the decline was the increase in bankruptcy.

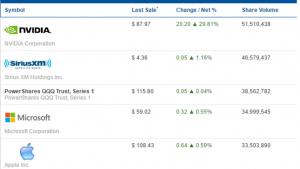

These are four most viewed companies regarding sales and shares

Ref: nasdaq.com (2016)

- NVIDIA: Its sales last year were $87.97, along with change in net percentage of around 20.20% to 29.81% and overall shares volume was 51,510,438.

- SiriusXM: Last year sales were $4.36, change in net rate 0.05 to 1.16% and overall shares volume was 46,579,437

- Microsoft: Last year sales were $59.02, change in net rate 0.32 to 0.55% and overall shares volume was 34,999,545.

- Apple: Last year sales were $108.43, change in net rate 0.64 to 0.59% and overall shares volume was 33,503,890.

By comparing the financial performance of these four large public traded companies, it can be seen from above information that this was the basic overview of internationally trading firms.

Global Dow and Global Dow Euro, both companies’ stocks are highly tradable in the international market with the higher closing price of shares.

Ref: online.wsj.com

Publically traded companies use different types of methods for measuring Capital Budgeting:

For example; one of the projects is Capital Budgeting: once project is decided, then the management team begins the financial analysis of the project whether the project should start or not. For this purpose, the company uses three financial capital budgeting tools:

- Payback period

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

Payback period is straightforward and a primary decision tool. In this era, the company determines how long the project will take to payback the initial investment. In order to analyze the results: first of all, the company will calculate the cost, and divide that cost by how much cash inflow it expects to receive in future, and the number of years for the payback period.

Payback period is straightforward and easy, but this does not mean that it will give ineffective results. When a firm generates a vast amount of cash flows in a shorter period then payback period helps the company to produce cash flows.

Net Present Value is more common and most widely used method for evaluating the performance of the project. NPV requires net cash outflows minus cash inflows. NPV is efficient because it uses discounted cash flow analysis, where the future cash flows are discounted at discount rate to compensate for the uncertainty of the project.

Finance Project Harvard Case Solution & Analysis

Internal Rate of Return (IRR) measures how much of return an investor can get. IRR is a discount rate that occurs when the project reaches break even (NPV equals to zero).

Another method when the company wants to become public owned company from privately owned company..............

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.