Delta/Signal Corp Case Study Solution

Delta/ Signal corp. should pursue the innovation strategy. It should target a niche to produce high quality customized products for the customers of luxury vehicle producers. The company should invest in Research and development to create innovation in its products as the industry giants like BMW are making huge investments in R&D department. As the US market of luxury cars is showing a growing trend and it is expected that this trend will remain same with the improvement in economy. The company should protect its proprietary technology developed by it and it should focus on the luxury segment with its innovation and customization. It will give an opportunity to grab a price premium by satisfying and retaining the targeted customers.

As the above balance score card describe the four perspectives including the financial perspective, business process perspective, customer perspective and learning and growth perspective. In financial perspective the company has to improve gross margins, operating margins and increase the sales and maximize the dividend and earning per share.(See appendix 2 for Balance Score card Analysis)

Strategic Map

Strategic map has been made to analyze how the selected strategy will work to achieve set targets. Strategic map identifies, with the alignment of chosen strategy, the process which should be followed to get desire outcomes. (See appendix 3 for Strategic map)

According to business process perspective the company has to design high quality products, improve the innovation process and engage suppliers in quality programs. While the customer perspective says that the company should be perceived as the high-quality provider and improve customer satisfaction and make regulations for the innovation and technology and the learning and growth perspective says that the company should invest in R&D and make the quality a priority.

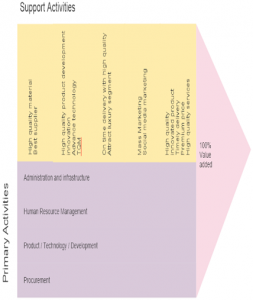

Value Chain Analysis

Value chain analysis has been performed to identify the desired outcome by going through set procedure. Which material should be use and it proceeds along with timely delivery? The results formulate the total value added, by the proposed strategy, to the company.(See appendix 5 for detailed value chain analysis)(L Rabelo, H Eskandari, T Shaalan, M Helal, 2007)

The company has a history of innovation and expertise in developing customized products therefore the company can capitalize its experience and enhance its opportunities in providing customized products to the niche. The company also has new products and systems in its pipeline that will attract the producers of luxury cars; fuel efficient system, integrated safety system, connectivity system and the like. Following is the proposed balance score card.

Budget Allocation

Delta/ Signal corporation has been provided with total of 25 million budget for applying chosen strategy by doing strategic initiatives. Budget allocation process with the help of selected objectives along with considering its selected metrics, proposed the following budget specification.

| Obj # | Met # | Initiative name | Budget |

| OF-5 | MF-5 | ||

| OF-6 | MF-6 | ||

| OF-9 | MF-9 | ||

| OF-10 | MF-10 | ||

| OF-11 | MF-11 | ||

| OC-2 | MC-2 | “High Quality”

Trade Marketing Campaign |

$1 |

| OC-5 | MC-5 | Customer

Satisfaction Promotions |

$1 |

| OC-11 | MC-11 | “Innovative”

Trade Marketing Program |

$1 |

| OC-12 | MC-12 | “No Questions

Asked” Replacement Policy |

$3 |

| OC-13 | MC-13 | R&D Partnership

Initiative |

$2 |

| OP-1 | MP-1 | BSC | $1 |

| OP-2 | MP-2 | R&D Initiative:

Wear-Resistant Parts |

$3 |

| OP-5 | MP-5 | R&D Process

Efficiency Initiatives |

$2 |

| OP-10 | MP-10 | Manufacturing Supplied

Component Quality Monitoring |

$2 |

| OP-18 | MP-18 | Manufacturing Supplier Quality

Engineer |

$1 |

| OL-2 | ML-2 | Research Tech.

Planning Tools Upgrade |

$2 |

| OL-3 | ML-3 | Product | $1 |

| OL-7 | ML-7 | Manufacturing Total Quality

Management (TQM) |

$2 |

| OL-10 | ML-10 | L-16 Manufacturing Quality Sourcing

Training |

$1 |

| OL-16 | ML-16 | R&D Engineer

Training |

$3 |

| TOTAL | $25 MILLION | ||

This table shows different selected objectives with to its respective metrics long with its initiative approaches, which provides us with this budget allocation of total of 25 million dollars.

Recommendations

After having a thorough analysis of the current situation of delta/ Signal corporation it is suggested that it should focus on the strategy of providing high quality innovative products to the niche luxury segment. It should target some specific luxury car manufacturers and provide extremely high-quality customized products rather than working on mass production.

It will also help in controlling the cost efficiently and effectively with a high premium price for the customized products. Cost cutting approach should be implemented strictly and quality management is a must for the success of the company accompanied by the customer satisfaction and employee motivation.

Conclusion

Delta/ Signal corporation is an automotive parts supplier, it is facing some unrest in its financials; decline in sales, increase in costs and low share price. The company hired a new CEO to tackle these issues; he has presented four different strategies to implement in the company with the help of consultants. After analysis it is recommended to implement the innovation strategy because the company has past expertise in customization and a potential increase in the luxury car demand in the US market as well as the move in the competitors focus from the US market to Asian region is a plus.

Appendices

Appendix:1 (SWOT Analysis)

| Strengths | Weakness |

| · Customized product

· 2,000 distinct products · 100 separate production lines · Good executive team |

· Decreased stock value, revenues, market share

· Material cost increases · Substandard results · Previously un specialized team |

| Opportunities | Threats |

| · Suggested strategies

· Expansion into Asia · Growing middle class · Low-cost strategy · Luxury segment |

· Lower priced cars

· Rivalry competitors · Introduction of new law to share technology formula in chine · Failure of suggested strategies |

Appendix: 2 (balance scorecard for selected strategy)

Appendix: 3 (Strategic Map for selected strategy)

Appendix: 4 (Value Chain Analysis for selected strategy)

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.

How We Work?

Just email us your case materials and instructions to order@thecasesolutions.com and confirm your order by making the payment here