CMH Case Solution

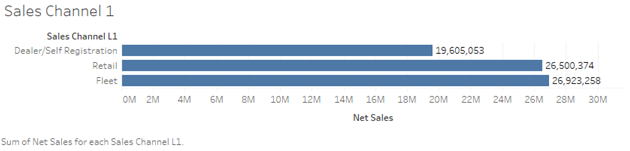

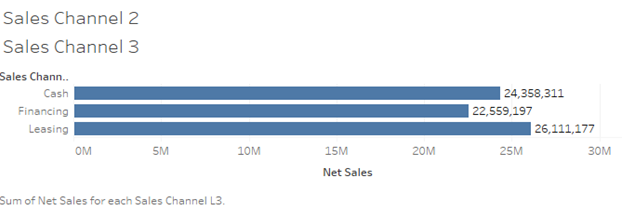

Figure 3.1: Sales Channel 1 with Net Sales

Figure 3.2: Sales Channel 2 with Net Sales

Figure 3.3: Sales Channel 3 with Net Sales

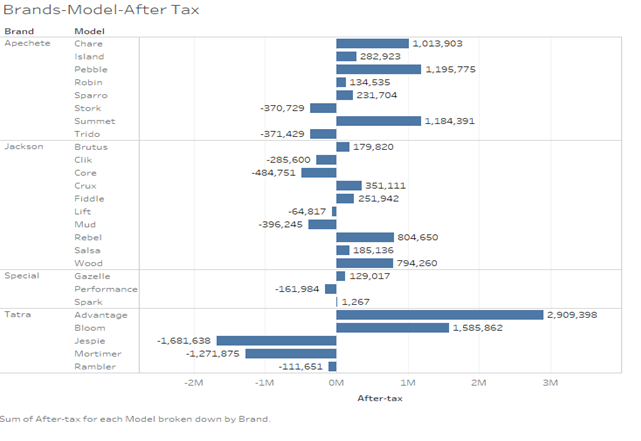

Most and Least Profitable Models

After the data collection process, the company wants to analyze its most and least profitable models. For this purpose, the company has analyzed the performance of its models by measuring its total after tax profits. Figure 4.1 shows the bar graph of its all models, and the representative values are showing after-tax total profits of the respective models. By measuring these values, it has been found that the most profitable model is Advantage, which has given around 3 million dollars after tax profits to the company, and it belongs to the Tatra brand.While, the least profitable model is Jespie which has given around -1.7 million dollars after tax profits to the company, and it also belongs to the Tatra brand, which helps to conclude that the best and worst performance of the company are coming from the Tatra brand.

Figure 4.1: Brands and Models with Total After Tax Amounts

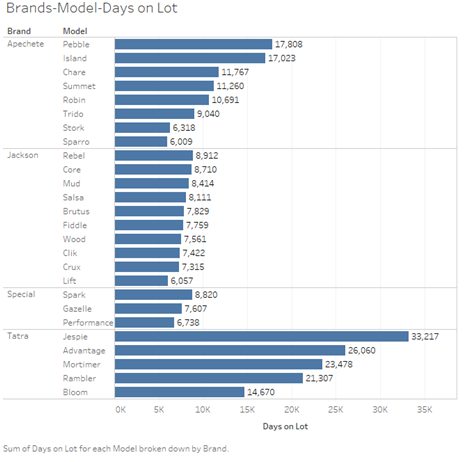

Models with Top and Bottom Sellers

After the data collection process; the company wants to analyze its most and least profitable models in each brand. For this purpose, the company has analyzed the performance of all of its brands,in order to find out that which model is generating higher sales for the brand, ultimately for the company, and which is the lowest net sales generating model in particular brand among the four brands that the company has:

- Figure 5.1 shows that the Pebble model is generating higher sales for the Apechete brand thus ultimately generating higher sale for the company, and Sparro is the lowest net sales generating model in Apechete brand. Moreover, the Advantage model is generating higher sales for the Tatra brand and the company, and Mortimer is the lowest net sales generating model in Tatra brand.In addition to this, the Wood model is generating higher sales for the Jackson brand and Clik is the lowest net sales generating model in Jackson brand. At last, the Spark model is generating higher sales for the Special brand of the company, and Performance is the lowest net sales generating model in Special brand.

Figure 5.1: Brands, Models and Net Sales

Recommendation:

Course of action:

Based on the analysis of the market, sales and highly profitable segments;the sales of the automotive products should be increased the USA, because it is the highest profitable country in the North American region. Other than the USA, the sales operations should be further expanded in South American region such as in Columbia, Venezuela, and Brazil. The recommendation of the countries to expand the sales in such particular countries is mainly based on the gross sales as shown in Figure 1.2.

Considering the brand performance, the two brands with highest net sales and contribution margin were Apechete and Tatra. In terms of after tax profits, Apechete had represented the highest value, whereas Tatra and Jackson were equal. Based on such facts, the two brands that the organization should focus on include Apechete and Tatra. Similarly, the organization is recommended to invest in other products, to bring an improvement in their features and characteristics, to grab the attention of the increased consumer base.

Tatra was the most profitable as well as the least profitable brand among all the four brands. Considering the after tax amount of each model of the brand, the sales of advantage should be increased whereas Jespie of Tatra brand and core and mud model of Jackson brand should be discontinued at the time. The discontinuation of these models is analyze the perception of customer-sand suggestions from the customers, in order to bring an improvement in the product offerings and relaunch the models in the market again.

Financial implications:

The approach to increase the sales of Apechete and Tatra were based on the highest net sales and contribution margin. The probability of these brands to bring further improvement in the sales would allow the organization to have enough money to pay its fixed costs and overhead expenses. Promoting the sales of high profitable sales and discontinuing the sales the brands representing declining sales would assist in saving the real-time production cost for a specific time period. This would allow the organization to experience-profitable growth through a significant increase in sales. An increased sales would allow the organization to expand the brand models. (Allen, 2003).......................

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.