Calaveras Vineyards Case Solution

- Assume you are advising Dr. Martinez in valuing Calaveras. Based on her projections (and including the additional capital expenditures discussed in the case) prepare a discounted cash flow valuation of Calaveras Vineyards.

For the calculation of free cash flows through we calculated the data from the case, unlevered beta was calculated to calculate weighted average cost of capital WACC. The beta is taken from the given data and through this the beta of the company is calculated as 0.906. Through a formula WACC was calculated to be about 8%. The average WACC was calculated based on the by taking into account the WACC of the projection years. This rate was then used for forecasting the free cash flows. The future cash flows are measured by taking into account different considerations such as depreciation and amortization, these both are non-cash items therefore, they are added back to the EBIT as they are deducted earlier to calculate the EBIT. Afterwards capital and working capital expenditures were deducted and finally free cash flow is calculated.

The growth rate is calculated to be 2% and again the average WACC was taken as 8.30, then NPV was calculated of the free cash flow. The NPV of free cash flows was then calculated as $10,494,000. By looking at the calculation it can be seen that the free cash flows are in positive as well as they are favorable. Free cash flows havean increasing trend thus; it has better business opportunities in the future.Withthistrend it can be saidthat it is wise to invest in the company as per valuation it is a company that has positive high returns in the future. The positive cash flows indicate the safety of the investment and they areattractive due to its viability.

Calaveras Vineyards Harvard Case Solution & Analysis

Since certain assumptions are used and different averages are calculated on which this FCFF is based on therefore, this could not be a final representative model to assess the company accurately.

Calaveras Vineyards Harvard Case Solution & Analysis

- Would you advise Dr. Martinez to purchase Calaveras’ at the proposed price? Why or why not?

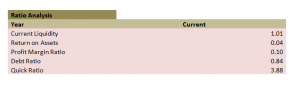

Dr. Martinez should buy Calaveras, firstly as per our calculation it is certain that the company will have future positive cash flows and thus, the company will have better future prospect. Another aspect is that by using ratio analysis, it is seen that liquidity may be a threat to the company however; the company has debt to equity ratio of 83.75% and is higher than the standard level of industry. The company has a very strong quick ratio that is above 3 and thus, it has more security against its loan obligation. This quick ratio can be used to mitigate the risk of being unable to pay off its obligation.

Return on asset is very low even with the industry average and should be considered by the company.Moreover, the company is anestablished one and has brand name in the market. The sales are in an increasing trend for the company and thus have greater future business. Furthermore,since Dr. Martinez is with the company from many years, therefore he has great understanding of the company and its structure. In addition, he has planned to take the company to next level, thus he can make the company prosper. All these factors make the company favorable at the proposed price.............

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.