Lcbo: Organizational Transformation Case Study Solution

Threats

Threats include the risks faced by an organization. The change in the market scenario of the industry pose various threats to LCBO like; entrance of grocery stores at large scale can wean the market share of the retail outlets of LCBO if certain customer oriented measures would not be taken.

External Assessment Pest Analysis

External assessment can be done through the PEST (Political, Economic, Social and Technological) Analysis

Political

LCBO has a favourable political environment as it is a Crown Corporation and only company allowing complete range of alcoholic beverages with a license.

Economic

Economic indicators for LCBO are also quite favourable with the industry growing at a high rate i.e. 3%.

Social

About 80% of the population of Canada consume alcohol and the age slab which consumes more alcohol is between 30-40 years. Society culture accepts the consumption of alcohol and allows people to consume alcoholic beverages.

Technological

The alcoholic beverages industry in Ontario is at its maturity stage and the technological advancement enjoyed by the LCBO is at its high level.

Assessment of Financial Data

Internal Assessment

For the internal assessment the employee’s motivation, the technological advancement, number of increasing outlets shows the strong corporate culture at LCBO.

External Assessment

External assessment of the financials of LCBO, by the investors and stakeholders can be done through analysing various growth indicators like, revenue growth over years, percentage of total expenses over total revenues, net income as percentage of total revenue and dividend paid to government. These indicator sprovided in the case study show a continuous growth pattern which indicates good expectations of the investors and stakeholders about the organizational performance.

Impact of Issues on LCBO’s Financial and Performance Metrics

The issue of entrance of grocery stores in the market can decline its market share in the industry. Therefore LCBO has decided to perform various activities which it was not doing before the entrance. It has increased the customer services to get customer’s loyalty, it has increased the salaries of its employees to make them more efficient by gaining employee’s motivation towards work. These all activities to cope up with the situation has increased the ratio of expense to its revenues.

However increase in competition in most cases increases the performance of an organisation and its efficiency in operations.

Assessment of Intended Strategic Direction of LCBO

The building of strong supply chain and a wholesale chain with the grocers shows its intentions to be an effective wholesaler in the market. Along with it LCBO’s intention to improve its strategic relations with the grocers as well as its determination to increase its internal efficiency by providing e-commerce services, customer care at its stores etc. provide us a quick assessment of the intentions of LCBO to become a world’s supplier of alcoholic beverages as a wholesaler, retailer as well as a distributor.

Does It Address the LCBO’s External Challenges?

The intended strategic direction of LCBO addresses its external challenges like the increasing completion, decreasing market share, customer switching etc. at a large scale as it is directed towards making LCBO a large wholesaler as well as retailer of alcoholic beverages.

Alternatives

Alternate-1:

LCBO should include retailing as its integral part of marketing. Most of its transactions are business to customers along with small amount of business to business transactions with The Beer Store, restaurants and bars. LCBO has a strong retailing channel with 654 retail stores.Since it has a huge number of retail stores therefore they need to incorporate technology and innovation in their process to keep an edge in the market.

Alternate-2:

The new strategy of LCBO to widen its reach in the market by introducing its wholesaling channel had some positive aspects. Since grocery stores were entering the market therefore company needs to develop its efficient wholesale channel to cater to this new market.Although currently they are not very efficient and some changes need to be implemented along with some investment in this regard but with this strategy company will be able to sell at a bulk quantity which in turn will provide greater returns for the company.

Alternate-3:

The company can launch a new hybrid model where it operates its retailing channel while investing in its technological advancements along with developing its wholesale channel to cater the new market. Since Grocery stores would be giving some tough time to the retail stores and reduce the profits of the company therefore hybrid will most likely address this issue.

Recommendations

LCBO’s mission to become a worldwide alcoholic beverage’s producer can be achieved by implementing its new strategy efficiently.

- Just by innovating its retail channels and increasing efficiency by introducing ERP systems would not improve its current market position by a huge margin therefore it can be said that although alternate-1 would not suffice to give an edge to the company.

- The new strategy of building wholesaling channels with grocers will increase the possibility of increasing the market share therefore the organization should adopt various strategies which would help in making grocers loyal towards it.But then company will lose their focus of innovating themselves therefore alternate-2 also doesn’t feel feasible.

- The hybrid model though seems very feasible for the company since the company will be innovating their operations along with opening wholesale channels which will allow them to sell inventory at bulk quantities.

Conclusion

Although, the LCBO has a great value to customers but the changing market scenario of alcoholic beverage industry will lead the organization’s returns to decline if certain measures would not be taken. Therefore in order to maintain its current position in the industry LCBO has considered deploying a hybrid which will not only help them retaining their current market position but also bring innovation in their processes.

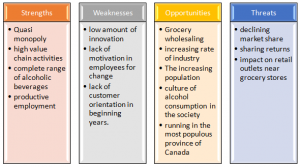

Exhibit 1: SWOT Analysis

Exhibit 2: PEST Analysis

Exhibit 3: Market Share by Volume Graph

Exhibit 4: LCBO Vertical Analysis

| LCBO: Vertical Analysis | |||

| Particulars | 2016 (in CA$ millions) | Vertical Analysis % | |

| Revenue | 5572 | 100.00 | |

| Less: Cost of Sales | 2785 | 49.98 | |

| Gross Margin | 2787 | 50.02 | |

| Add: Other Income | 54 | 0.97 | |

| Less: Selling and General | 870 | 15.61 | |

| Income From Operations | 1970 | 35.36 | |

| Add: Finance Income | 1 | 0.02 | |

| Less: Finance Cost | 4 | 0.07 | |

| Net Income | 1968 | 35.32 | |

Exhibit 5: Analysis of LCBO Growth

| Analysis Of Growth Of LCBO | |||

| Growth Indicator | 2015 | 2016 | % Change |

| Number Of Customer Transactions | 130885 | 137244 | 4.86 |

| Average Transaction Value Per Customer | 39.84 | 40.58 | 1.86 |

| Full Time Equivalent Employees | 6469 | 6665 | 3.03 |

| Product Listings | 3938 | 4077 | 3.53 |

| Revenue Growth Over Previous Year | 3.8 | 7.2 | 89.47 |

| Total Expenses As % Of Total Revenue | 16 | 15.5 | -3.13 |

| Net Income As % Of Total Revenue | 34.6 | 35 | 1.16 |

| Number Of Stores | 651 | 654 | 0.46 |

| Number Of New Stores | 23 | 14 | -39.13 |

| Dividend Paid To The Government In CA$ Millions | 1805 | 1935 | 7.20 |