Apollo Tires: Investment Decision Dilemma Case Solution

Assess the worth of Apollo Stocks as of march 31, 2012, using the discounted cash valuation model?

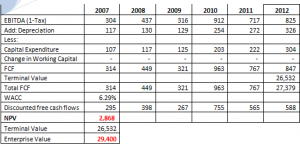

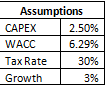

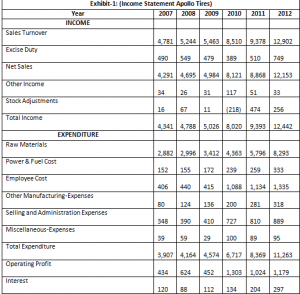

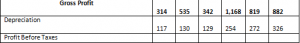

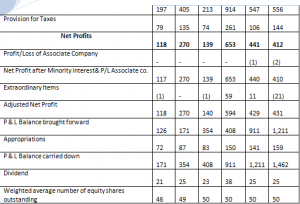

Using discounted cash flow valuation model to estimate the enterprise value, certain assumptions were made, in which the capital expenditure was assumed to be 2.5% of annual sales revenues and the weighted average cost of capital was assumed at 6.29%. Which would be used to discount the cash flows on annual basis. Furthermore, the tax rate was estimated at 30% by evaluating the tax rates present in the income statement, an average was taken of the annual percent of tax calculated by dividing the provision for taxes by the profits before taxes. Additionally, after analyzing the sales growth of the company, a 3% growth rate was assumed depending upon its profitability and expenditures.

In addition to this, the DEBIT was taken, while subtracting the tax amount at 30% on profits, then the depreciation for the year was added in which the capital expenditure was subtracted from the amount, calculated by multiplying the capital expenditure rate at 2.5% by the sales revenues to determine the free cash flows of the company. Furthermore, the terminal value was calculated by multiplying the last free cash flow with (1-Growth rate) and dividing by the result from the subtraction between WACK and Growth rate.This would be used to determine the present value of the free cash flows after discounting to acquire the Net present value of the company and adding the terminal value generated from the above formula to get the actual enterprise value of the organization.

Exhibit-3

Based on your Analysis would you purchase Apollo for your equity portfolio?

It would be recommended to Santana to go through with the investment, as it would account towards increase in the returns generated from his equity portfolio. Which was derived,based on the analysis conducted, using unlettered discounted cash flow valuation model. It can be determined that the results achieved from these analytical tools are promising. Furthermore, after analyzing the historic as well as current condition of Apollo in the market, which helped to identify the significant growth it had experienced over the years, which can be evaluated from the exhibits attached. Therefore, it can be determined that, the overall position of Apollo was sufficient to ensure its long-term survival and growth in the market and the enterprise value calculated under discounted cash flow valuation model amounting to 29,400,000. This was sufficient to ensure that the investment would result towards enhancing the equity portfolio's worth in the future and could attribute towards gaining higher returns from the investment made.

Apollo Tires Investment Decision Dilemma Case Study Solution

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.